The Internal Revenue Service is having trouble coordinating various overlapping programs that deal with referrals on tax evasion, in part because the referrals have to be submitted on paper forms, manually screened and then mailed to various departments within the IRS.

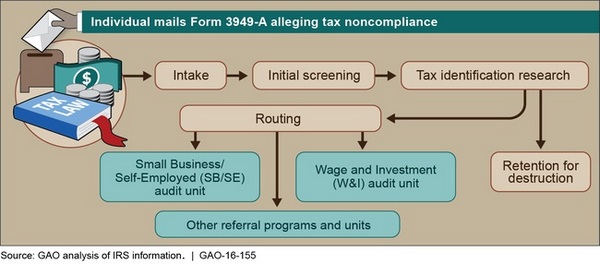

A new report from the Government Accountability Office examined the coordination between the IRS’s different referral programs and the IRS Whistleblower Office, which pays out rewards to tipsters. The referrals can also come internally from sources such as the IRS’s Return Preparer Office and the Large Business and International Office of Tax Shelter Analysis. However, information referrals from the public alleging tax noncompliance must be submitted on paper forms by mail to the IRS. The referrals are then manually screened by clerical staff and routed by mail to units across the IRS for further action.

The report found that ineffective internal controls are undercutting the IRS’s ability to manage the information referral process. The “IRS does not have an organizational structure for information referrals with clear leadership for defining objectives and outcomes for measuring cost-effectiveness and results,” said the report. “Without clear leadership, IRS does not know how effectively it is leveraging information referrals to address the tax gap.”

The IRS received approximately 87,000 information referrals in fiscal year 2015.

Reports by the public of suspected underreporting of taxes or other tax violations can help the IRS detect millions of dollars in taxes that would otherwise go uncollected, the report pointed out. Productive referrals can help address the net $385 billion tax gap—the difference between the amount of taxes paid voluntarily on time and the amount owed.

The report noted that the IRS has incomplete documentation of the procedures for the information referral process, increasing the risk of delays and added costs in routing the information for further action. One-quarter of the information referrals in fiscal year 2015 were sent for destruction after screening, even though the IRS has no documented procedures for supervisory review of those referrals prior to destruction. The lack of procedures to address these control deficiencies compromises the IRS’s ability to know how effectively it is leveraging tax noncompliance information reported by the public.

Fragmentation and overlap across the IRS’s general information referral process and eight specialized referral programs, such as for reporting identity theft and misconduct by tax return preparers, can confuse the public trying to report tax noncompliance to IRS. Yet coordination between referral programs is limited, and IRS does not have a mechanism for sharing information on crosscutting issues and collaborating to improve the efficiency of operations across the mix of referral programs. As a result, the IRS may be missing opportunities to leverage resources and reduce the burden on the public trying to report possible noncompliance.

The GAO recommended, among other things, that the IRS establish an organizational structure that identifies responsibility for defining objectives and for measuring results for information referrals. The IRS should also document the procedures for the information referral process and establish a coordination mechanism across the various IRS referral programs. The IRS agreed with the GAO’s recommendations.

“Information referrals are a key mechanism for the public to report potential tax noncompliance to the IRS, and this information has the potential to assist the IRS in identifying tax revenue that may otherwise go uncollected,” wrote IRS deputy commissioner for services and enforcement John M. Dalrymple in response to the report. “Currently, the IRS has several avenues in which alleged tax noncompliance by individuals and businesses can be reported. Our specialized information referral programs include identity theft, misconduct by tax return preparers, abusive tax promotions, and wrongdoing by tax-exempt organizations. Individuals submitting these referrals can do so anonymously, and this operates outside our Whistleblower Program (which is for individuals who are seeking a financial award).”

He noted that in fiscal years 2012 through 2015, approximately 7 percent of the information referrals led to audits, a rate significantly higher than the IRS’s overall audit rate of less than 1 percent. The audits based on those referrals yielded over $209 million in additional tax assessments.