The Securities and Exchange Commission has been launching enforcement actions against various types of financial fraud schemes, with improper revenue recognition seen as the most common type of fraud, according to a new analysis.

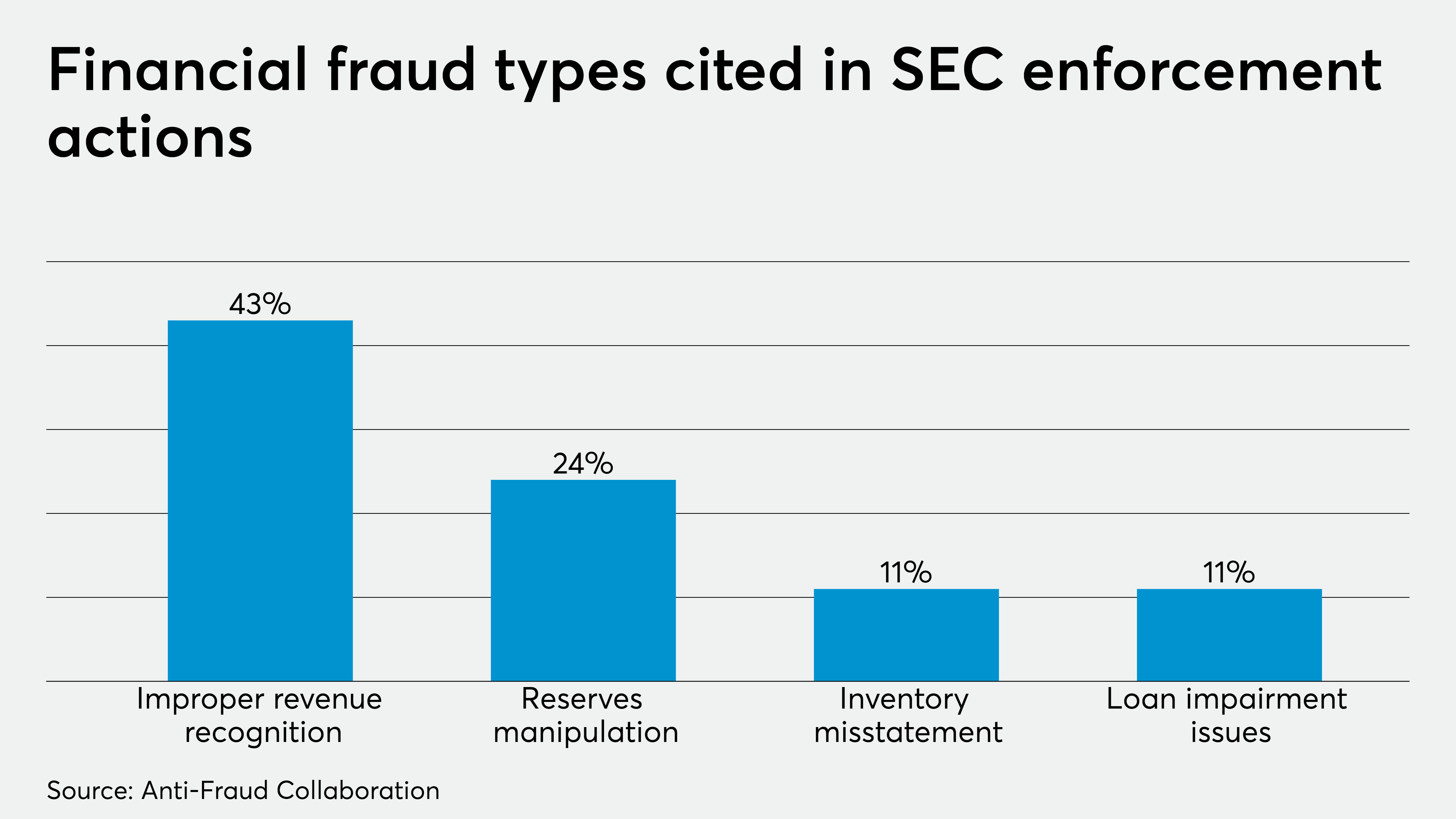

The report, released Tuesday by the Anti-Fraud Collaboration — a joint effort of the Center for Audit Quality, the Institute of Internal Auditors, Financial Executives International and the National Association of Corporate Directors — analyzed over 500 SEC enforcement actions filed in recent years and found the most common type of fraud incident was improper revenue recognition (43 percent), followed by reserves manipulation (24 percent), inventory misstatement (11 percent) and loan impairment issues (11 percent). The study based the numbers on 531 Accounting and Auditing Enforcement Releases, or AAERs, filed between 2014 and 2019, finding 140 financial statement fraud schemes across 204 enforcement actions.

Some industries were charged more often than others in the SEC enforcement actions. Technology services companies (17 percent) were the most commonly charged industry, followed by finance (13 percent), energy (11 percent) and manufacturing (9 percent).

“The risk of financial statement fraud at public companies is real, and that risk has only increased during the pandemic,” said CAQ executive director Julie Bell Lindsay in a statement. “Deterring and detecting fraud requires extreme vigilance from all participants in the financial reporting system — regulators, internal and external auditors, audit committees, and especially public company management.”

The study found members of public company management were more likely to be charged in SEC enforcement actions than other individuals, with CFOs the most commonly charged employees (54 percent), followed by CEOs (31 percent).

The SEC announced enforcement action against companies of all sizes. Seventy-nine AAERs (39 percent) were filed against companies with less than $250 million in market capitalization, while 44 enforcement actions (22 percent) were filed against small-cap companies. Twenty-two AAERs (11 percent) were filed against mid- and large-cap each.

The study also looked at the circumstances that could have contributed to fraud. In the enforcement releases, the SEC cited several contributing factors, including the tone set by top executives, a high-pressure environment, and a lack of experienced personnel. Companies can combat fraud by exercising professional skepticism, zeroing in on high-risk areas across companies along with company-specific risks, and performing regular quantitative and qualitative risk assessments.

“Members of the financial reporting supply chain can learn from the AAERs how controls were circumvented,” said outgoing IIA president and CEO Richard Chambers in a statement. “From continuing to evaluate and improve the strength and efficacy of internal controls to ensuring an ethical tone and standards at the top of the company, all players can work together to prevent financial statement fraud.”