Senators and House members introduced legislation to help taxpayers survive the pandemic, with tax credits for developers revitalizing homes in “distressed” neighborhoods and enabling small businesses to pay essential expenses.

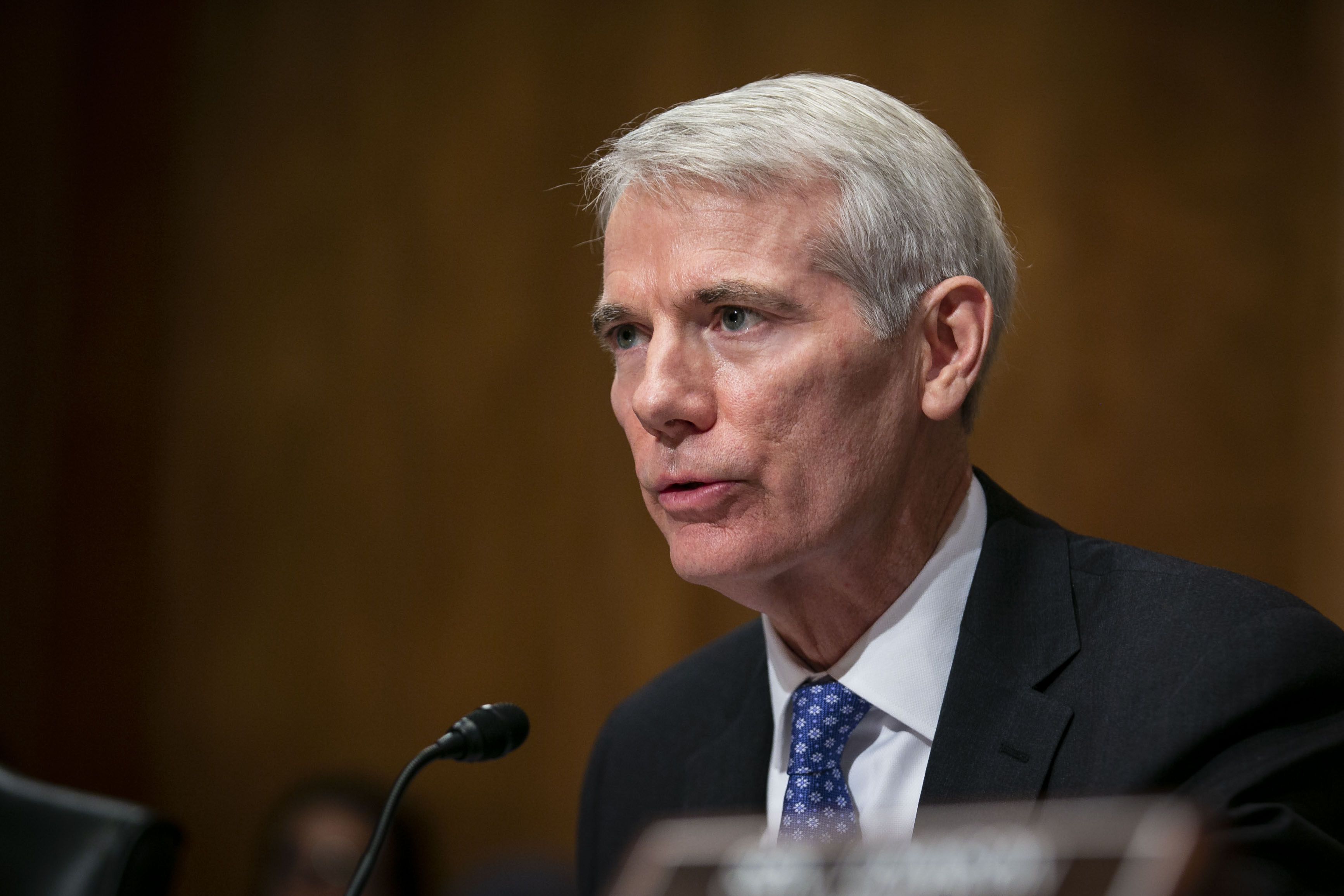

Senate Finance Committee members Sen. Rob Portman, R-Ohio, and Ben Cardin, D-Maryland, introduced a bipartisan bill Thursday, the Neighborhood Homes Investment Act, supported by several other Republicans and Democrats in the Senate. It would create a federal tax credit to help pay the costs in urban and rural areas where the cost of purchasing and renovating homes is greater than the resale value of the homes. It would cover the cost between building or renovating a home in these areas and the price at which they can be sold. The bill would also help existing homeowners in these neighborhoods renovate and stay in their homes.

Another bipartisan bill, known as the Keeping the Lights On Act, was re-introduced Thursday by House Ways and Means Select Revenue Measures Subcommittee Chairman Mike Thompson, D-California. It would provide federal support to small businesses to help them pay essential fixed costs, such as rent or utilities, during the coronavirus pandemic. It would create a new, fully refundable payroll tax credit that covers 50 percent of fixed costs for businesses that have either 1,500 or fewer employees, or $41.5 million or less in gross receipts.

Both bills come at a time when the U.S. continues to suffer from the economic and health effects of the COVID-19 pandemic. The last stimulus package passed in December with bipartisan support and included a new round of Economic Impact Payments for upwards of $600 for individual taxpayers, along with $284 billion for the Paycheck Protection Program for small businesses, as well as other initiatives to help with distributing the coronavirus vaccine and other priorities.

However, Democrats’ plans to pass a $1.9 trillion relief package with an extra $1,400 in Economic Impact Payments and other forms of relief is running into objections from many lawmakers on the Republican side of the aisle. The two bipartisan bills may represent some common ground that emerges in whatever compromise legislation comes out of the talks between the two sides.

Investing in homes

Portman’s bill comes only days after he announced his intent not to run for re-election, citing the increasing difficulties in breaking through the partisan gridlock in Washington. He sees his bill as a way to do that while helping struggling neighborhoods.

“The Neighborhood Homes Investment Act provides a tax credit to rehabilitate blighted homes and help revitalize neighborhoods across America and Ohio,” Portman said in a statement. “This tax credit will encourage opportunity and investment in neighborhoods that are often home to vulnerable populations and marked by stagnant housing markets, foreclosures, and blighted or vacant homes.”

He and the other sponsors see it as a way to build on the New Markets Tax Credit, opportunity zones and the Low-Income Housing Tax Credit.

Portman and Cardin believe their act could lead to the revitalization of 500,000 homes and create $100 billion in development revenue over the next 10 years. They noted that 22 percent of metropolitan areas nationwide and 25 percent of non-metro areas would qualify for NHIA investments. The bill targets neighborhoods that have poverty rates that are 130 percent or greater than the metro or state rate; have incomes that are 80 percent or less that area median income; and have home values that are below the metro or state median value.

The bill would require that homes constructed or revitalized under the program must be sold to homeowners making less than 140 percent of the area median income to ensure that improved housing directly benefits members of the communities targeted by the new tax credit. In addition, the credits would only be given for houses constructed or revitalized in census tracts that meet certain minimum metrics related to median gross income, poverty rates, and home sale prices. The credits would only be available after the homes have been completed and sold to a homeowner. The maximum credit amount would be the lesser of 35 percent of total development costs (property acquisition plus construction and/or rehabilitation cost) or 80 percent of the national median home sale price.

The tax credits would be awarded to project sponsors — such as developers, lenders and local governments — through a competitive statewide application process administered by each state’s housing finance agency. The sponsors in turn would use the credits to raise investment capital for their projects. Investors could claim the credits against their federal income tax when the homes are sold and occupied by eligible homebuyers. State agencies would have an annual allocation of either $6 per capita or $8 million, whichever is higher.

Helping small biz

The House legislation, the Keeping the Lights on Act, aims to help small businesses pay for rent, utilities and other essential costs, during the pandemic. It was originally introduced in May 2020 and was re-introduced Thursday. The bill builds on existing programs to provide immediate relief during the coronavirus pandemic through the Tax Code to small and midsized businesses for keeping critical business infrastructure in place.

“Our local small businesses have been hit hard by the economic impact of the coronavirus pandemic and it’s essential we continue providing support so they can stay open,” Thompson said in a statement. “They need help not just to make payroll, but to pay fixed costs, like rent or mortgage payments, to stay afloat. … This is a simple tax credit that can make the difference not just for small companies, but for the workers they employ, and the local job markets they support.”

It would provide a fully refundable payroll tax credit to cover 50 percent of fixed costs for businesses that have either 1,500 or fewer employees, or $41.5 million or less in gross receipts.