A group of senators has introduced bipartisan legislation Thursday to extend the tax-filing deadline from April 15 to July 15 after guidance from the Treasury Department and the Internal Revenue Service extended only the tax payment deadline in response to the novel coronavirus pandemic.

The Tax Filing Relief for America Act provides for basically the same timeline as the Treasury and IRS guidance that was issued this week, which allowed taxpayers to avoid extra interest and penalties if they pay their taxes by July 15. But the official guidance would still require taxpayers to file their tax returns by April 15. The legislation would enable taxpayers, along with their preparers, extra time to file their taxes without filing for an extension.

Accountant organizations such as the American Institute of CPAs, the National Conference of CPA Practitioners and the National Society of Accountants have urged the IRS and Treasury and give taxpayers more time to do their taxes as COVID-19 spreads across the U.S. and other parts of the world.

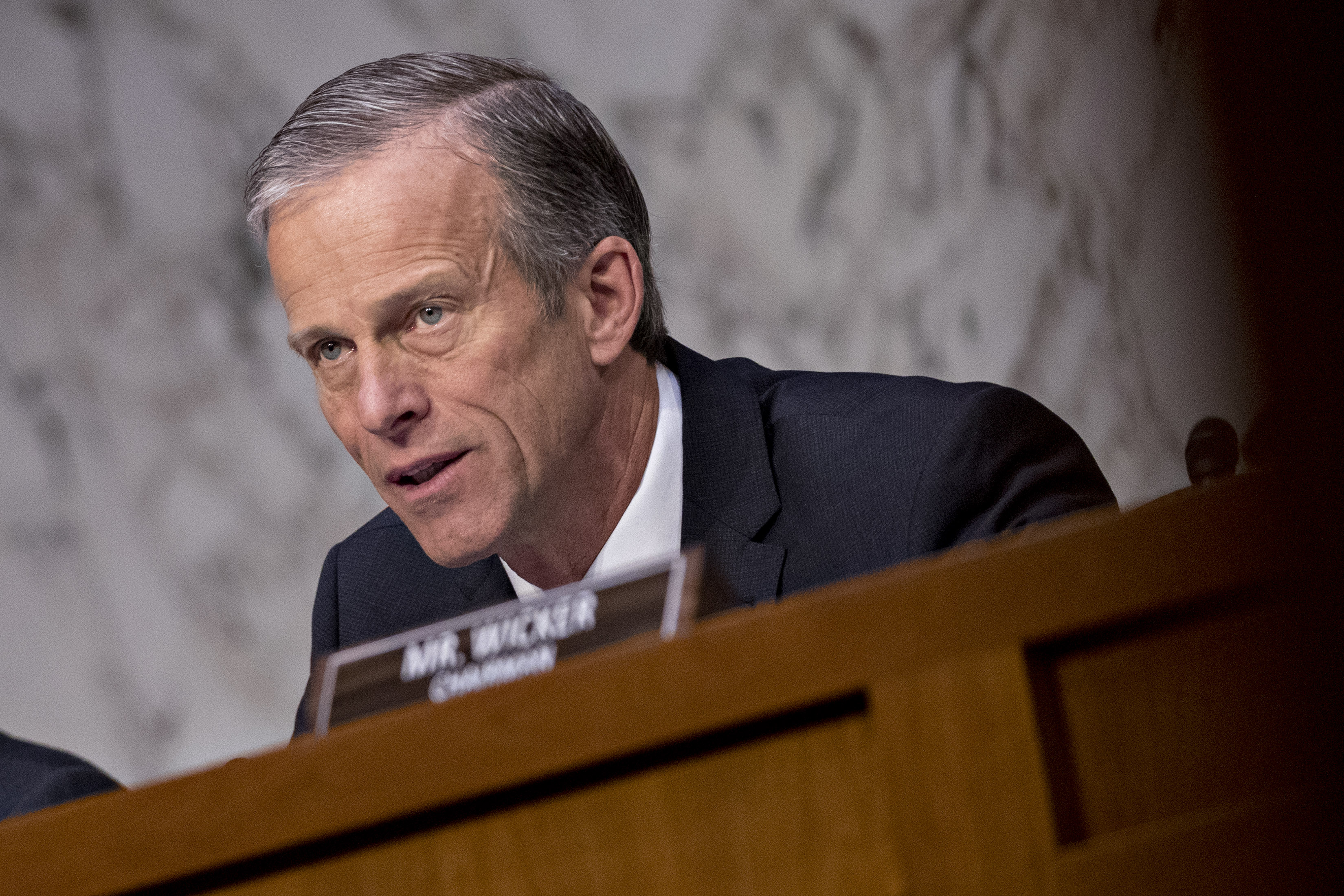

The bipartisan legislation was introduced by Sen.. John Thune, R-S.D., Steve Daines, R-Mont., and Angus King, I-Maine, and is co-sponsored by Sen. Richard Burr, R-N.C., and Chris Van Hollen, D-Md.

The bill aims to provide more clarity to taxpayers and enable those who need to travel to a secondary location to acquire documents or meet with an accountant to follow the Center for Disease Control and Prevention’s guidelines about the coronavirus, while preserving the right of taxpayers who are owed refunds to file their tax returns and get their money back.

“Treasury’s decision to extend the tax payment deadline from April 15 to July 15 was an important first step, but it only makes sense to also extend the tax filing deadline itself,” Thune (pictured) said in a statement Thursday. “There’s enough confusion amid this outbreak as it is, so I believe it’s incumbent upon Congress to provide as much clarity and relief as possible to American families. While I’m working with my colleagues on additional swift and bold action to respond to the ongoing coronavirus outbreak, this is the least we can do, and I hope my colleagues will support this effort.”

The AICPA praised the bill. “During this unprecedented time, taxpayers and tax practitioners are finding it increasingly difficult to comply with upcoming filing deadlines,” said AICPA vice president of tax policy and advocacy Edward Karl in a statement. “Businesses and individuals struggling with coronavirus-related issues should not also be concerned with meeting upcoming tax filing deadlines. The AICPA is grateful to Senator Thune for his leadership on this critical issue and we support his efforts to provide Americans with much-needed tax filing relief in the midst of this national emergency.”

Both the AICPA and the National Society of Accountants have expressed dismay about the guidance issued Wednesday by the IRS and Treasury. “The AICPA understands the need for economic stimulus and, if possible, those who can file and get refunds should do so now,” said AICPA president and CEO Barry Melancon in a statement Wednesday (see our story). “However, it is impossible for every taxpayer and their tax adviser to prepare returns in this environment. Nearly 60 percent of all taxpayers turn to a tax practitioner to prepare and file their tax returns, and individual and business tax filing deadlines are fast approaching. Even the relatively simple process of filing an extension form requires calculations based on data and information from the taxpayer. Given the current environment, this extension process is impossible for many taxpayers. Treasury must act immediately by extending the April 15th filing deadline and providing more clarity on the details of recent relief actions.”

NCCPAP also criticized the limitations on the relief offered by the Treasury.Department (see our story). “Individuals are being forced to remain in their residencies, by their own choice or otherwise,” wrote NCCPAP president Neil Fishman in a letter to Treasury Secretary Steven Mnuchin. “Facilities for older individuals, including independent living and assisted living facilities as well as nursing homes, have closed themselves off entirely to the public. The only people allowed to go into these facilities are employees—even family members are not allowed to enter. These individuals, in particular, rely on a tax return professional to assist them with the preparation of their tax returns, and we do not have access to them or their information.”