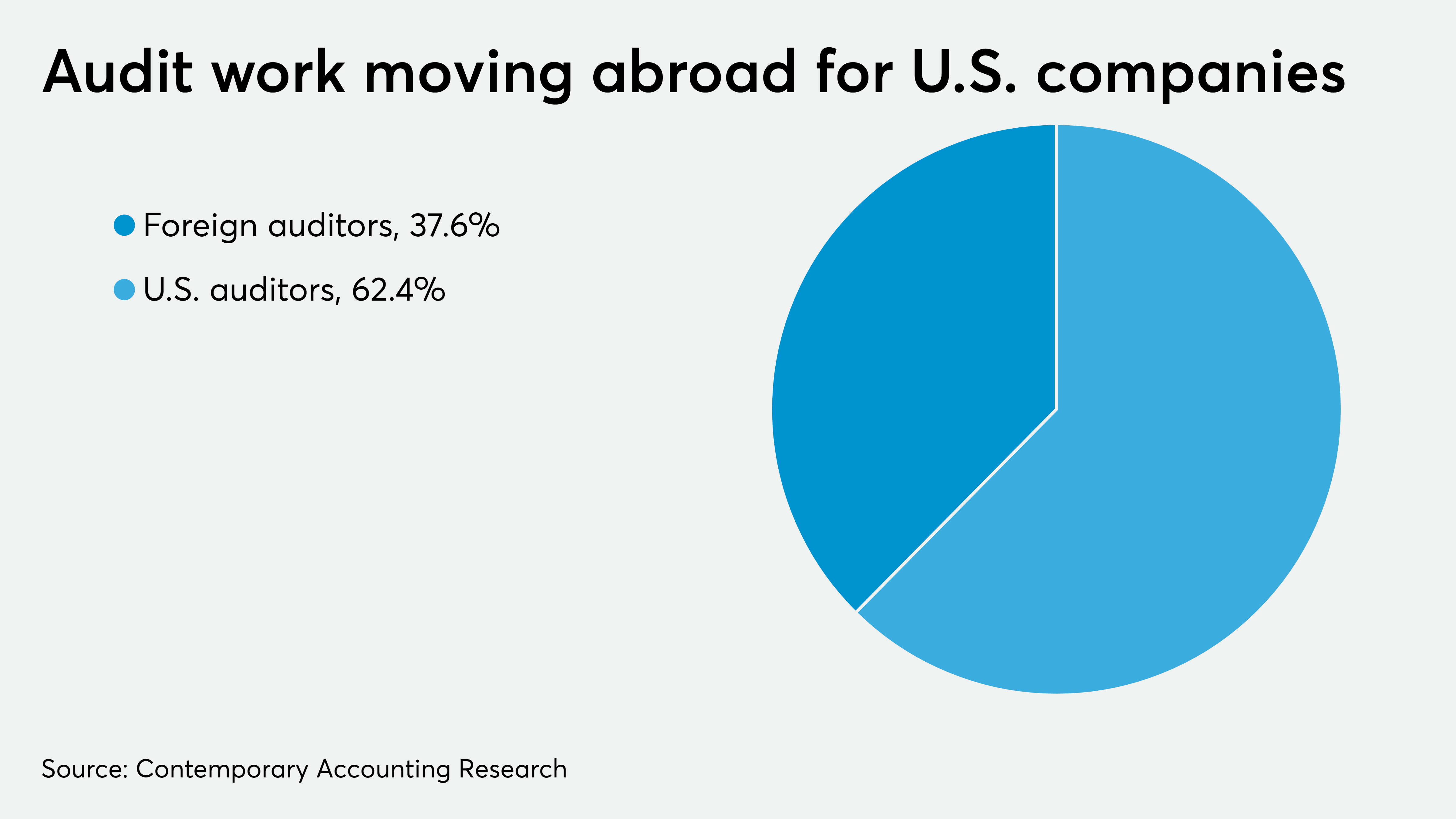

Over one-third of U.S. public company audits rely on at least one audit firm abroad, according to new research.

The report found that 37.6 percent of U.S. public company audits utilize at least one foreign audit firm. For those that do, on average they’re using 3.7 percent foreign auditors to conduct 17.7 percent of the audit. The figures reveal that certain companies are more exposed to risk outside the U.S. than others.

The study, conducted by professors Jenna Burke of the University of Colorado Denver, Rani Hoitash of Bentley University and Udi Hoitash of Northeastern University, will be published in an upcoming issue of the academic journal Contemporary Accounting Research. The researchers pointed to recent cases such as the alleged accounting fraud at the German payments company Wirecard, whose audit firm, an Ernst Young affiliate, has come under fire for overlooking irregularities.

They drew their findings from Form AP filings with the Public Company Accounting Oversight Board. Starting in 2017, the PCAOB mandated the disclosure of foreign auditor use for public company engagements on the new Form AP. The lead audit firm in the U.S. has to individually identify, by firm name and location, each foreign audit firm that conducts over 5 percent of total audit hours, offering a rich source of information for researchers on the extent of overseas involvement in U.S. audits, in addition to the role played in certain markets for audits abroad.

In addition to Germany, the researchers also found a large market in China, where the PCAOB and the SEC have recently been cracking down on audits, with the Trump administration threatening to delist companies whose auditors refuse to allow PCAOB inspections.

Form AP data indicated that several high-profile companies, including General Motors, Cabot Corp, Hasbro, JH, Starbucks, Steve Madden and Tesla, have up to 10 percent of their audit work done in China.

In general, U.S. auditors aren’t legally allowed to do their work in foreign jurisdictions, either directly or remotely, so they’re often forced to rely on foreign audit firms or affiliated member firms within their international networks, such as EY Germany. The type of work done by foreign auditors can vary widely, from conducting an inventory count to performing a full-scope audit. Firms have been forced to rely even more on foreign auditors this past year with the COVID-19 pandemic, which has hindered travel abroad more than ever before.

“Many of the largest U.S. companies faced extreme audit coordination issues, where audit work in countries with significant operations is not completed or completed differently than in the past,” said the researchers. “This is likely to impact the reliability of their financial statements. Investors can look to Form AP to determine the extent a company is impacted by this risk.”

Thanks to the Form AP data, the researchers were able to identify the percentage of work conducted by foreign auditors by specific major U.S. companies and the countries in which significant audit work is conducted on their behalf.

“Using a new PCAOB data source, we can now identify the materiality of work conducted by foreign component auditors,” said Rani Hoitash. “Historically, their level of participation was not clear. This is particularly relevant as audit quality issues are revealed for specific foreign component auditors (such as EY Germany) and as the COIVD-19 epidemic restricts travel and thus audit supervision around the world. Both will likely impact the reliability of affected financial statements.”