Christine Kuglin

In July 2011, in response to growing public concern over employment-related identity theft, the Treasury General for Tax Administration announced that the Internal Revenue Service could do more to assist taxpayers by informing them if fraudulent income was being reported under their social security numbers.

This commonly occurs when an SSN is misused by an individual to obtain employment. TIGTA wanted the IRS to identify and flag tax returns that had an SSN on third-party documents, but the tax return was being filed with an Individual Taxpayer Identification Number as its tax identifier. Once the return was flagged with this ITIN/SSN mismatch, the SSN owner would be notified their number had been used on someone else’s return. During tax years 2009-2013, the IRS ITIN program found that an average of 24 million annual individual tax returns contained discrepancies in the form of an ITIN/SSN mismatch.

In August 2016, TIGTA published a report highlighting that the IRS had “not established an effective process to send the required notice to the Social Security Administration (SSA) to alert it of earnings not associated with these victims” of identity theft. The TIGTA commentary provides a timely reminder of how current U.S tax policy may have adverse consequences for certain taxpayers, since the IRS allows a tax return to be electronically filed even when it includes an ITIN that fails to match the corresponding SSNs on third party W-2s.

This policy potentially conflicts with a tax preparer’s professional responsibility to adopt a sufficient level of due diligence, as prescribed by Circular 230, so it is important to ascertain how professionals are currently dealing with this ethical and professional dilemma. In order to explore this issue, the researchers at Metropolitan State University of Denver recently surveyed accounting professionals, paid tax preparers, and volunteers in the Volunteer Income Tax Assistance program, about their views on mismatched tax verification documents, and whether clients should be advised to certify tax returns prepared using conflicting source information. The contacted individuals included CPAs, Enrolled Agents, accounting academics and accounting students. Approximately 2,000 accounting professionals and students were contacted, and surveys were completed by 99 and 28 CPAs and EAs, respectively.

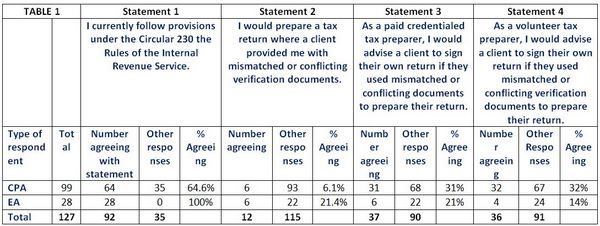

The MSU Denver survey asked respondents whether they follow the rules within Circular 230. The survey then asked the respondents about the extent to which they agree or disagree with a series of statements about whether they would prepare a tax return and allow a client to sign such a return in situations where a client provided mismatched or conflicting income verification documents. The survey used a five-point scale for classifying responses, ranging from strongly agree, agree, undecided, disagree, to strongly disagree. Selected results from the survey are provided in Table 1. For presentation purposes, the “strongly agree” and “agree” responses for each statement have been combined together into a single column entitled “number agreeing.”

Statement 1 focused on determining whether respondents followed Circular 230 when preparing tax returns, and 100 percent of EAs agreed with this assertion. In contrast, only 64.6 percent of CPAs agreed with this statement. Of the 35.4 percent of CPAs who did not agree, 70 percent claimed to be undecided about whether they followed Circular 230, with the remainder choosing not to answer the question.

Andrew Holt

Statement 2 explored whether respondents would prepare a tax return where a client provided mismatched or conflicting verification documents. Only 6.1 percent of CPAs agreed they would prepare a tax return in such situations. In contrast, 21.4 percent of EAs said they would complete a return using mismatched documents. Of the other responses, a total of 22 CPAs and EAs chose to not answer this question.

In terms of expected results, the researchers expected to see an inverse relationship between each respondent’s answers to statements 1 and 2, as a tax preparer exercising due diligence in accordance with the requirements of Circular 230 should be reluctant to prepare a return based upon conflicting verification documents. While this was clearly the case for the majority of respondents, 21.4 percent of EAs would still prepare a return under such conditions, even though 100 percent of the EAs surveyed agreed that they followed Circular 230.

Allan Rosenbaum

Statements 3 and 4 explored whether respondents would advise their clients to sign their tax return if it was prepared using mismatched or conflicting documents. Statement 3 posed this statement from the perspective of a paid credentialed tax preparer, and statement 4 posed it from the perspective of a volunteer tax preparer, such as a volunteer at a VITA site. The results for both statements 3 and 4 provided further evidence of a strong inverse relationship with each respondent’s views about statement 1, although in both scenarios, more than 30 percent of CPAs would advise their client to sign a tax return if mismatched or conflicting documents were used during its preparation. The percentage of EAs who agreed that clients should be advised to sign such returns, was relatively lower, with 21 percent and 14 percent stating that paid and volunteer preparers, respectively, would advocate client certification despite a source document mismatch.

In summary, the results of the survey raise a number of questions about the extent to which the current IRS policy on ITIN/SSN mismatches is potentially influencing the practices of CPAs and EAs, in both the paid and volunteer tax preparatory arenas. While survey data is still being collected, the data to date highlights a potential tension between the need to follow the due diligence requirements of Circular 230 against a preparer’s professional concern for their clients. Are clients really best served by a paid or volunteer tax preparer that allows them to sign a tax return prepared using mismatched verification documents? Clients are signing under the jurat of the 1040: “Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.”

Anh Silvain

Best practice would suggest not, especially when this advice could potentially harm the client, the preparer, and those third parties whose SSNs have been misused. Clearly action is needed to tackle the ITIN/SSN mismatch issue. Despite having an ethical and professional responsibility to adopt the highest levels of due diligence, tax preparers are facing increasing pressure to prepare returns using mismatched information, the survey results suggest. As one respondent commented, “Congress or the IRS should think about a better regulation to avoid such a conflict,” while another stated that their chief concern was not for their client, but “for those whose identity has been compromised.”

Christine Kuglin, MPAcc, CFE, EA, is a professional in residence in Metropolitan State University of Denver’s Department of Accounting. Dr. Andrew Holt is an accounting professor at MSU Denver. Dr. Allan Rosenbaum (deceased) was an author of many current tax laws who was honored in Washington, D.C., last year for his contributions. Anh Sylvain is on the audit staff at the accounting firm Hein Associates and was educated at MSU Denver.