New Jersey Governor Phil Murphy signed legislation Monday giving small businesses in the Garden State a workaround for the $10,000 cap on state and local tax deductions under the Tax Cuts and Jobs Act.

The Pass-Through Business Alternative Income Tax Act, which passed the New Jersey legislature last month, permits flow-through businesses in New Jersey, such as sub-S corporations, partnerships, LLCs and sole proprietorships, to elect to pay income taxes at the entity level instead of at the personal income tax level.

The New Jersey Society of CPAs applauded the legislation. “We are grateful to the Governor, the Legislature and all those who supported the bill,” said NJCPA CEO and executive director Ralph Thomas in a statement Monday. “Their dedication to assisting small businesses in New Jersey does not go unrecognized.”

He noted that NJCPA president-elect Alan D. Sobel, a managing member at SobelCo in Livingston, originated the concept of the pass-through entity legislation and helped write the law, which is estimated to save New Jersey business owners $200 to $400 million annually on their federal tax bills.

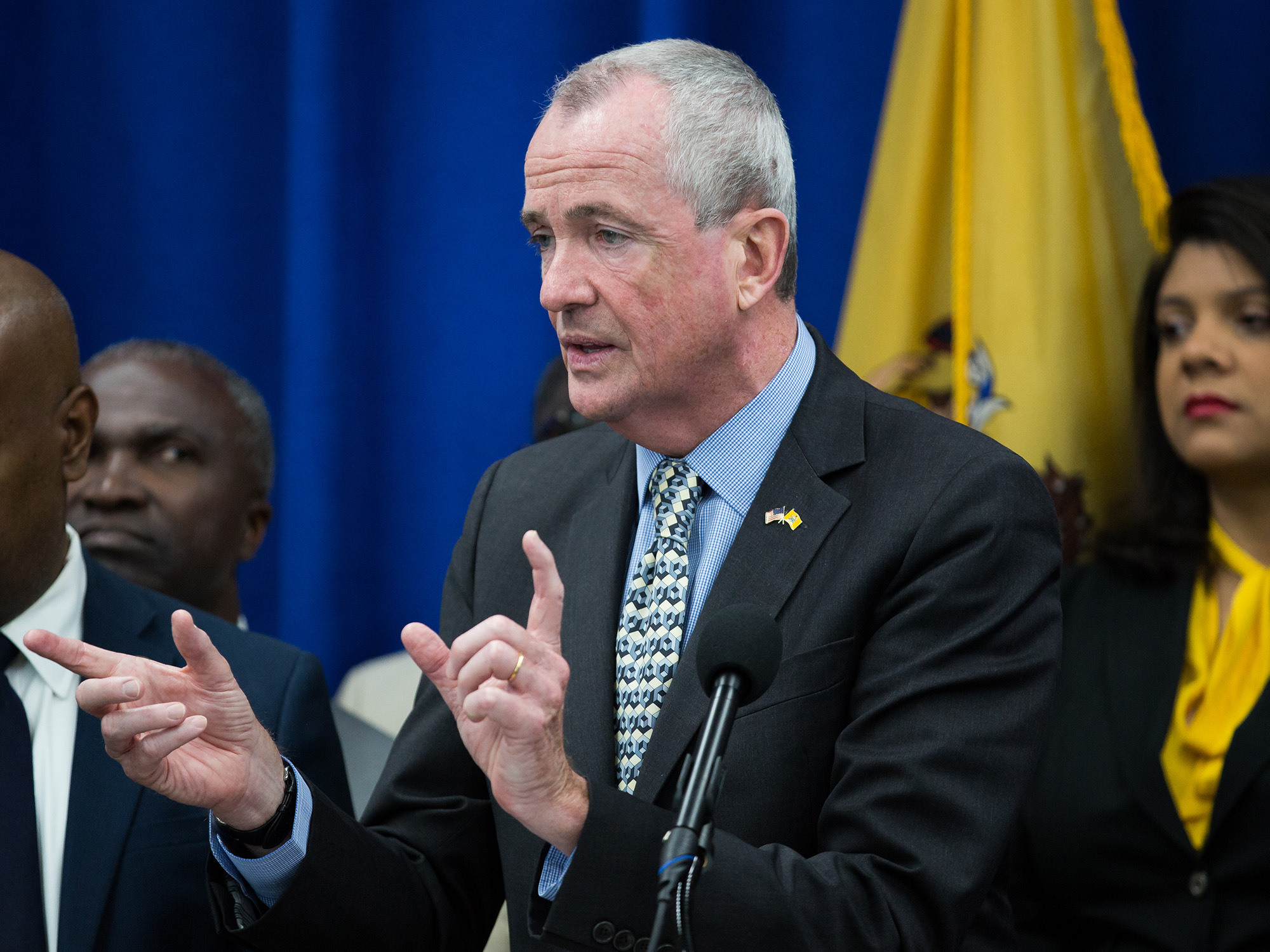

Some high-tax states such as New Jersey have moved to pass legislation over the past two years aimed at blunting the impact of the $10,000 cap on state and local tax deductions in the 2017 tax overhaul, amid complaints that the Tax Cuts and Jobs Act unfairly discriminated against so-called “blue states” run by Democrats like Murphy (pictured) in New Jersey and Andrew Cuomo in New York. New York, for example, set up state-run charitable funds that taxpayers could contribute to as a way of paying their state taxes and receive tax credits in return, along with a payroll system that employers could use to reduce their taxes. However, the U.S. Treasury Department and the Internal Revenue Service issued regulations last year that effectively prevent state-run charitable funds from being used as a way to circumvent the state and local tax limits (see Treasury deals final blow to SALT cap workarounds in high-tax states). However, the tax workarounds for businesses have not been barred as yet.