Forget Uber and TaskRabbit: A growing cohort of the gig workforce is actually working long-term inside traditional companies — and they’re pretty happy about it, according to new research from ADP.

According to a study of data from 18 million workers at 75,000 companies, one in six workers inside those companies is a gig worker, or over 16 percent of their workforce. Roughly half of those are 1099-MISC contractors, and half are short-term W-2 workers, according to Ahu Yildirmaz, co-head of the ADP Research Institute, which produced the study, “Illuminating the Shadow Workforce: Insights into the Gig Workforce in Businesses.”

The number of these gig workers has grown 15 percent over the last decade, at a rate faster than the overall workforce, and they’ve increased their share of the workforce by 2.2 percentage points.

Perhaps more important is the fact that their attitude toward their work status is very positive.

“Only 10 percent of respondents say they’re doing it because they can’t find traditional work. So it’s really a choice,” Yildirmaz told Accounting Today. “I was surprised — I wondered if they were doing it because they can’t find jobs, but that’s not the case. These are really highly skilled people who don’t need benefits.”

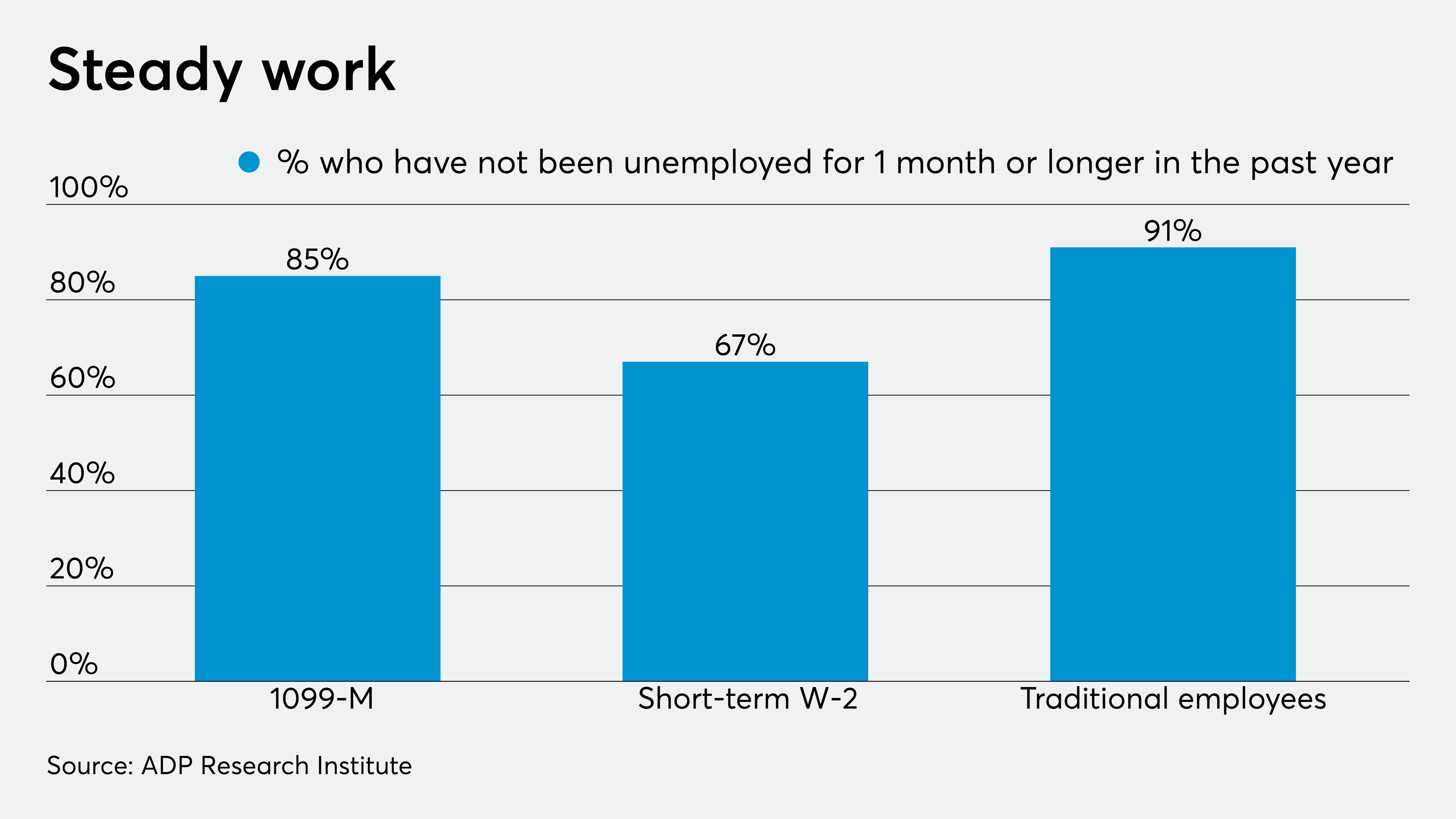

That’s particularly true of the 1099-M contractors, who tend to be older — 30 percent are over age 55, versus the 20 percent who are over 55 in the broader workforce — and with much less uncertainty around their work than you might expect, with over half (53 percent) reporting that they worked all year for the same company. They’re also well-compensated and happy in their work: Almost 40 percent reported that “doing what I enjoy” is of primary importance to them.

“What we are seeing is that these 1099 workers are skilled workers, they’re older, they’re tenured, and they are doing skilled work — accountants, IT specialists and legal are good examples,” explained Yildirmaz. “It feels like the baby boomers are retiring traditionally, but they’re actually staying in the workforce, with no need for benefits, no financial worries — they just want to continue to work. They want to have a purpose, they like the flexibility, they like the way they control how they work, and there’s demand for them because employers are finding it incredibly challenging to find skilled workers. … There is a huge need for experienced accountants, for instance, and for IT specialists.”

Accompanying the growth in this type of business-driven gig work is a shift in attitudes.

“We know that contractors and freelancers were always there, but the ‘gigging’ of the world is impacting how they look at the world of work,” said Yildirmaz. “And people are also living longer — they don’t want to leave the workplace. Contractors didn’t used to be older workers. … Millennials are reporting that they’re 1099-M workers, but they say they’re doing traditional work. They don’t see this work as untraditional. The mindset is very different now.”

The mindset is also different on the employers’ part. The average 1099-M contractor costs roughly $300 more than a regular employee, but it’s an expense companies seem willing to incur.

“Now you have to think, ‘Do I want to hold onto all my skilled workers? Do I want to own and retain them?’” Yildirmaz said. “Ten or 20 years ago, 1099-M employees were really about cost savings or companies preparing for recession. It was a PL issue, but I don’t think that’s the case now. This is a very natural outcome of labor and supply in the economy. There’s demand for the skilled worker, and there’s supply, mostly coming from this cohort” of older workers.