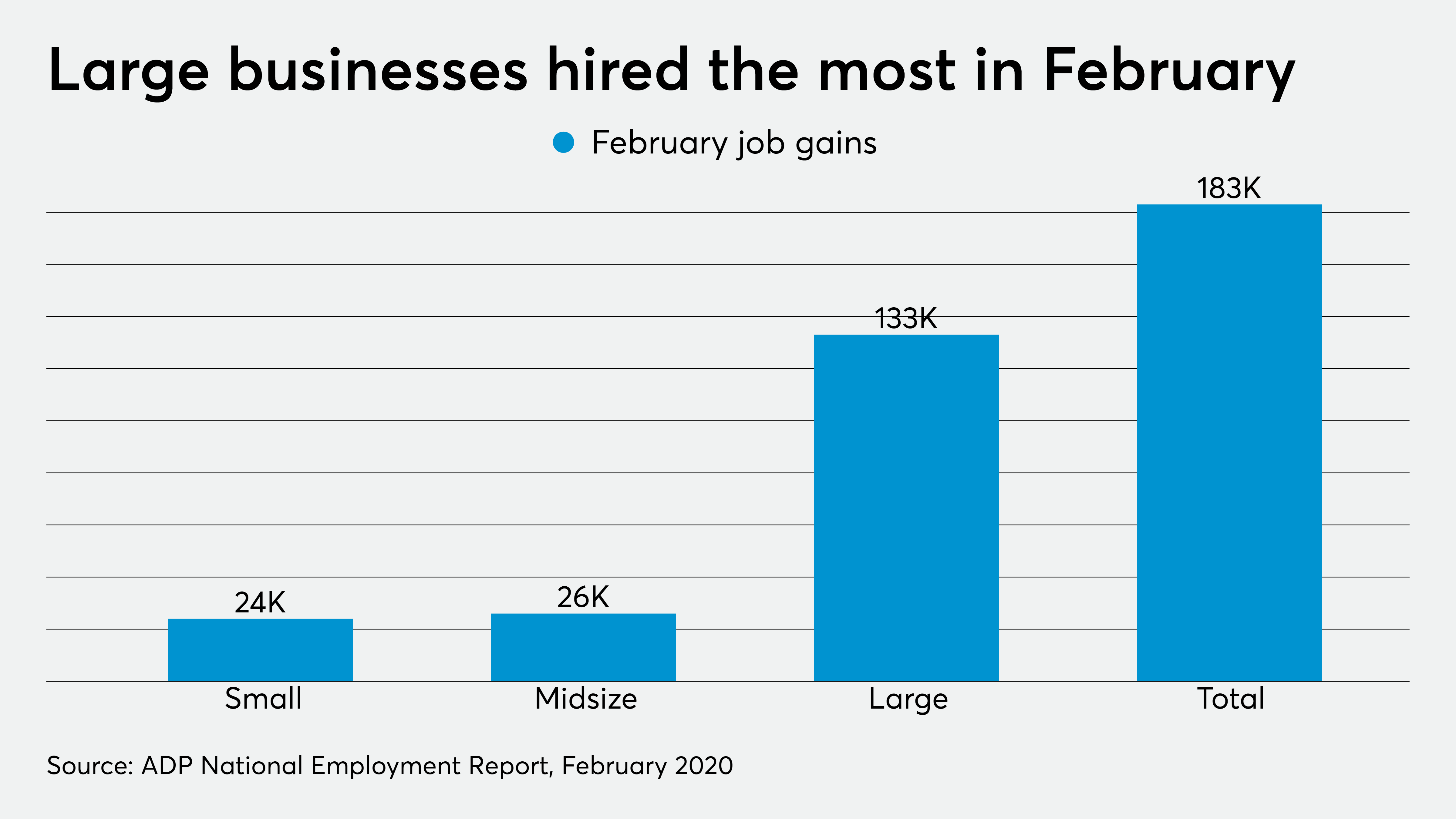

The private sector added 183,000 jobs in February, according to payroll giant ADP, especially at large companies, although the figures mainly come from before the outbreak of the coronavirus in the U.S.

Small businesses added 24,000 jobs in February, including 8,000 at businesses with between one and 19 employees, and 16,000 at businesses with between 20 and 49 employees. Midsize businesses with between 50 and 499 employees gained 26,000 jobs. Large businesses added 133,000 employees, including 5,000 at companies with between 500 and 999 employees, and 128,000 at organizations with 1,000 employees or more.

Service-providing businesses accounted for most of the job gains, at 172,000, including 38,000 in professional and business services such as accounting and tax preparation, as well as 9,000 in financial activities like banking.

Goods-producing businesses added 11,000 jobs in February. Franchise employment increased by 20,800 jobs.

“The labor market remains firm, as private-sector payrolls continued to expand in February,” said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute, in a statement Wednesday. “Job creation remained heavily concentrated in large companies, which continue to be the strongest performer.”

ADP added data on around 2 to 3 million more employees this month to its national employment report for this month’s report, according to Mark Zandi, chief economist at Moody’s Analytics, which produces the monthly report with ADP. He noted, however, that the figures largely come from the coronavirus made much of an impact in the U.S., through the week of Feb. 12.

“The February employment of over 180,000 was probably juiced up a little bit by weather, much like the January number, which had a relatively strong gain in employment likely due to the mild winter weather,” Zandi said during a conference call with reporters Wednesday. “You could see that in the strong gains on the construction trades. Low interest rates are helping to support the housing market. Then the other sector that got boosted was the leisure and hospitality industry.”

However, he expects those gains to fall off in subsequent months, especially if the coronavirus spreads in the U.S.

He expects growth to slow substantially for the rest of the first quarter and in the second quarter due to the coronavirus, also known as COVID-19. “How significant will obviously depend on the path of the virus and how widespread the virus becomes,” said Zandi. “It does appear, if you buy into what the CDC [Centers for Disease Control] and health experts are saying, this is going to be meaningful and quite widespread and will be disruptive. It’s likely we are going to see some meaningful disruption to travel, tourism, trade, transportation. There may be some school closings, and daycare and business closings in certain communities. That now appears to be the most likely scenario. If so, then we will see much slower growth and recession risks will rise quite significantly.”

In the meantime, ADP’s data has already been seeing some slowdown in hiring at the smallest businesses over the past year due to the labor shortage and competition with larger companies. “We’re continuing to see relatively weak job growth at smaller companies, particularly those with less than 20 employees,” said Zandi. “This happened starting a little over a year ago. Employment growth among these companies essentially went flat, so we haven’t seen any employment growth there for a little over a year. That’s been offset to a significant degree by relatively strong growth by very large companies with over 1,000 employees. They seem to be doing pretty well compared to the smaller guys. There are a lot of potential reasons for that. One significant reason may be the tight labor market, given all the open job positions. Smaller companies have a tough time holding onto their workers, particularly when there’s lots of competition from the bigger players that offer higher salaries and more benefits and other perks.”

Separately, ADP has been offering a system called DataCloud to help employers find employees in accounting and other sectors. “We have 30 million employee records in here and over 90,000 companies, and this gets refreshed on a monthly and quarterly basis,” Imran Ahmed, director of product marketing for DataCloud, recently told Accounting Today. “We keep expanding our job types. A few months ago, we had 2,500 job types in our system. We have over 5,000 different job types now, from over thousands and thousands of positions.”

Firms and companies can use the system to identify the right salaries to offer an accounting manager. “When an organization wants to use it to their advantage, one of the big things is they want to see if they’re paying their employees properly,” said Ahmed. “That’s a big deal in terms of retention of talent and to attract new talent. If you’re not paying competitive salaries in the industry, you might not gain as much talent as you want. If you’re hiring for certain positions, and you haven’t been able to hire anyone for five months, you might not understand why. If you’re only going to pay $40,000 to $50,000 for this job, and in reality candidates know this job, based on the market value and other research, that it’s $75,000, you can see if you’re way off the mark.”