Businesses are seeing their employees’ expense reports changing since the start of the coronavirus outbreak, with hotel and airline cancellation charges giving way to more requests for work-from-home charges.

AppZen, a provider of artificial intelligence auditing technology for expenses and invoices, has been keeping a close watch on the expenses that its customers have been processing in the weeks and months since the pandemic began spreading across the U.S.

“We have been tracking this since the start of the outbreak, initially just to see what’s new and what’s surprising, and also to figure out if our taxonomy is able to catch any new kinds of expenses,” said AppZen CEO Anant Kale (pictured). “Initially, the spend was regarding cancellations, as you would expect. A large part was related to no-show fees in hotels, where employees didn’t have the opportunity to cancel their hotel bookings and suddenly you would see thousands of dollars being charged where the travel was not completed. In the initial weeks, that was a very high spend that companies had related to travel cancellations.”

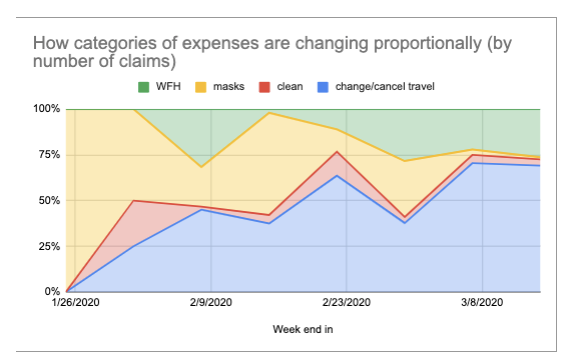

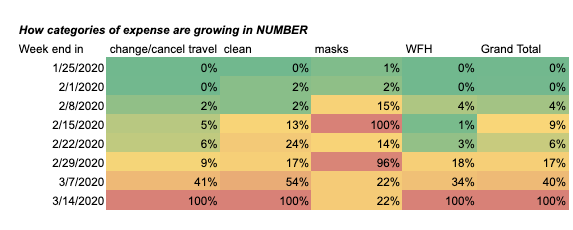

Those expenses started coming down slowly, and travel-related expenses were down 40 percent in March compared to last March. But AppZen then saw an uptick in working-from-home expenses.

“That was not a category we had seen called out in policies that companies had written, but it was essentially a new kind of spend that was coming up,” said Kale. “Most of it was related to COVID. Initially we also saw employees expensing things like the purchase of N95 masks. In some cases, we saw cleaning supplies being bought and expensed. In those cases, we were noticing that employees were doing everything they had to do to keep the business operations running, to react to the situation out there.”

Gradually, AppZen started seeing more work-from-home charges being expensed on various types of items that employees realized they would need for their home offices, such as desks, HDMI cables, laptops, monitors, keyboards, printers, ink cartridges, headphones and internet access. Office supply expenses were up 80 percent in March compared to March 2019, especially in the construction, information and professional services sectors. That in turn caused employers to begin updating their policies to deal with the kind of expenses that were proliferating and to try to rein them in more tightly.

“Essentially, from a place where your charges [were] conforming to the policy of a company, you suddenly saw new kinds of spend happening, something that hadn’t been called out and those policies written for it,” said Kale.”Initially what we saw was companies were adapting to it and letting those things go through, just to make sure their employees were safe and taken care of. As the work-from-home-related charges have come up more and more and continued, we are seeing more rules written around how much can be spent on each of these. They have to go through IT or the purchasing process.”

In addition to updating their expense policies, companies are now looking more closely at analyzing where the money is being spent, especially as more of them have been forced to cut back on expenses as cash flow is curtailed in many industries.

“Companies are asking us for more visibility into the spend,” said Kale. “They want to understand their spend in a much more granular way than traditionally what they were used to. We have seen increasing requests from customers around getting into more detail about what the spend is. … How much are they spending in each of those categories? What was it earlier? What are the terms that are favorable to them? There have been increasing requests around visibility and analytics from our customers.”

Ultimately companies are looking to reduce their spending as much as possible as the economy continues to unravel and sources of income dry up. “Everybody seems to be under some sort of process where they want to find out where they can cut, and getting visibility quickly into all their spend is really important for them to create a plan and achieve that,” said Kale. “That’s what seems to be going on. That’s really where we’re seeing a huge amount of interest, in insights. That’s where they very quickly merged AP with the corporate card. We are seeing a lot of people interested in what are my categories, where am I spending, and then that’s what’s helping them more in driving the plan to focus on areas to cut.”

Companies are rewriting their expense policies, looking more closely at accounts payable and automating more of the processes that used to be done by employees.

“There’s an enormous amount of pressure on the finance organizations to do more with less, so the other area where we are seeing a lot of interest is how can we make our process more efficient,” said Kale. “Here are the manual steps we do in validating our invoices, checking our invoices, and how can you automate those? I think that’s also related to the newfound focus on efficiency that they want to draw out of their processes.”