The COVID-19 pandemic is forcing corporate tax departments to reconsider their top priorities for this year, according to a new survey.

Bloomberg Tax Accounting polled a group of corporate tax professionals before and after the outbreak of the novel coronavirus disease in the U.S. about staffing, mandates, challenges and concerns. The survey found differences in the responses received from 321 corporate tax pros in mid-April compared to the 408 who responded in January.

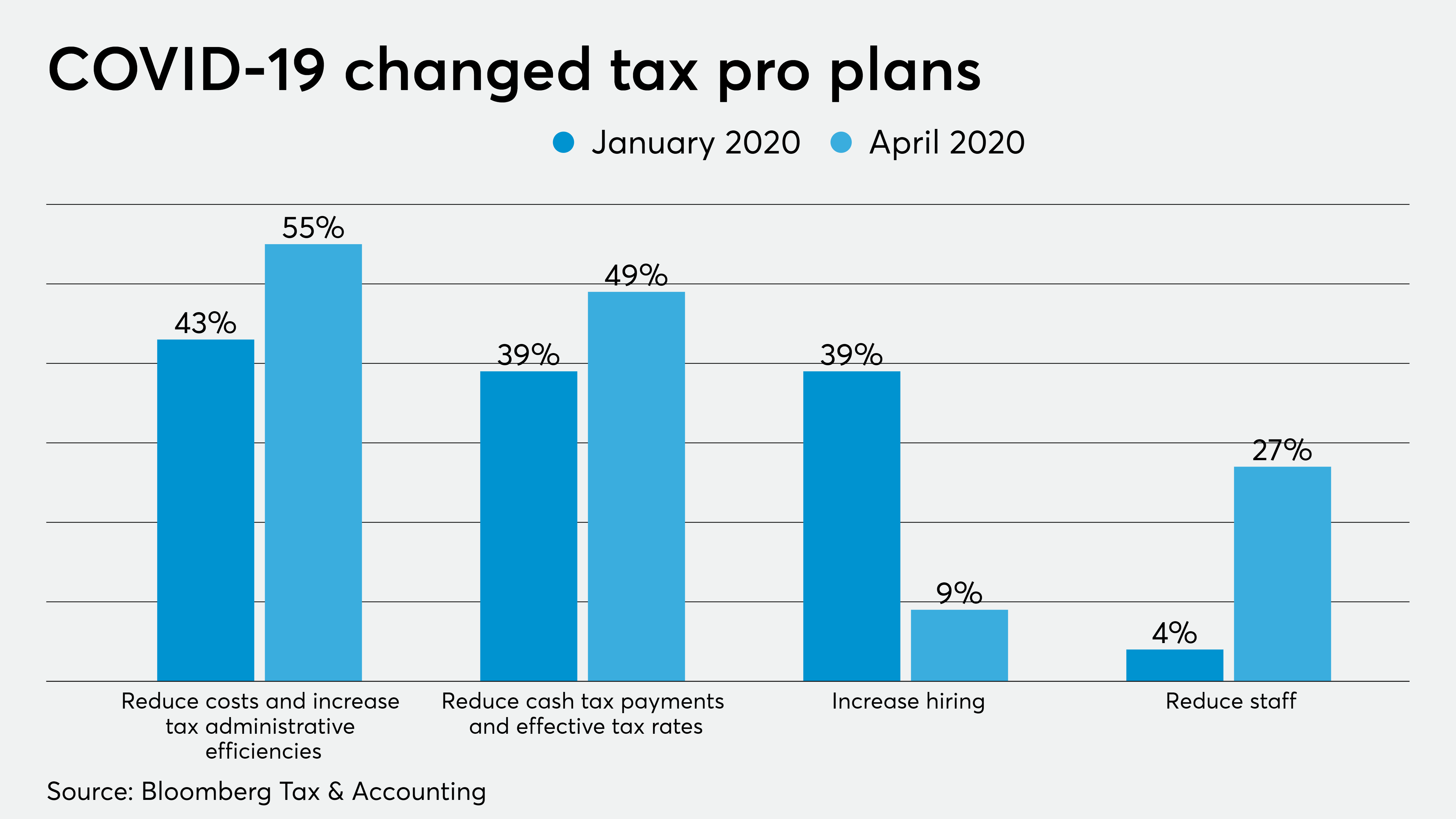

Their top mandates now are to increase cash management by reducing costs and increasing tax administrative efficiencies (55 percent, up from 43 percent pre-COVID-19) and to reduce cash tax payments and effective tax rates (49 percent, up from 39 percent pre-COVID-19).

The tax pros’ responses also showed a significant shift in the kinds of challenges they’re confronting. At the start of the year, almost half the respondents (45 percent) said that deploying or improving technology was among the biggest challenges for their tax departments in the year ahead. But the coronavirus has interfered with those plans, with tracking tax law changes cited as the top challenge in the face of the pandemic.

Hiring and staffing have also been disrupted by COVID-19. At the start of the year, 39 percent of the corporate tax pros polled indicated that they planned to increase hiring, but now only 9 percent say they will increase hiring, with the majority (64 percent) planning to maintain the status quo. There was also a significant increase, from 4 percent earlier this year to 27 percent in April, among the respondents indicating they plan to reduce staff this year.

“Corporate tax departments’ priorities in early 2020 have been inexorably altered due to COVID-19, as many corporations that were investing in business growth strategies are now challenged with minimizing expenses and maximizing cash savings,” said Bloomberg Tax Accounting president Lisa Fitzpatrick in a statement Thursday. “Corporate tax leaders have shifted their focus from planning to staying on top of the many changes brought on by COVID-19-related federal tax law changes and the state treatment of those changes — while challenged by doing so on account of limited resources and even reduced staffing and budgets.”