In today’s competitive marketplace, buyers wield a great deal of power and — as most businesses shift to work-from-home arrangements — do much of their research online. Knowing what buyers need, where they do their research, and what influences their decisions are all key to a firm’s success. And, according to the 2020 High Growth Study, it can be the engine of extraordinary growth.

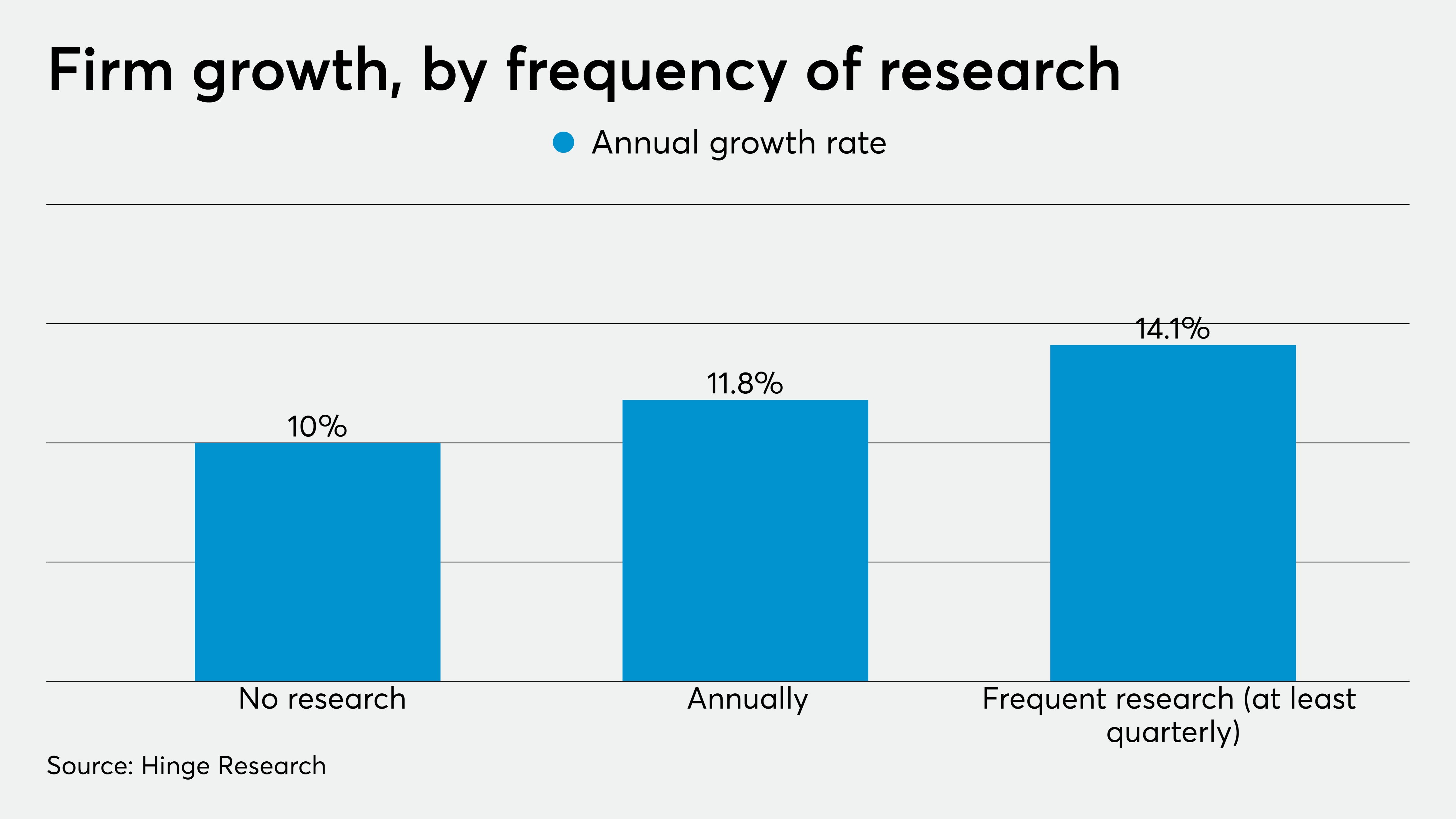

The data on high-growth firms makes a clear link between frequent research on target audiences and faster growth. As shown in the chart below, doing even occasional research accelerates growth — but conducting research at least quarterly speeds up growth by 40 percent. These are the same companies that grew at three times the rate of their peers and were twice as profitable.

The brain and brawn of growth

There are two reasons for market research’s impact on growth. First, as markets shift and face disruption, firms that have stayed abreast of their clients’ changing needs and priorities are better poised to serve them. This business intelligence gives a significant competitive advantage to firms that rely on anecdotal, perhaps unreliable, information.

Second, original target audience research provides the core of high-value content. Potential and existing clients, especially in today’s uncertain marketplace, are hungry for key industry trends and insights based on credible research. A firm can flex its expertise and gain prominence in the issues that matter to its audience by sharing insights through social media, online publications, webinars and podcasts, to name a few. The information and insights firms can uncover through original target market research are essential to an effective content marketing program — especially one designed to serve the needs of an audience conducting its market reconnaissance almost exclusively online.

In short, you can argue that original target audience research provides insights into your audience’s most important issues and offers fodder for reaching out to, attracting and nurturing leads.

3 basic methods

You can conduct target market research in three ways.

1. Analyze your own firm’s experience. Most professional services firms are built on the knowledge and skills of their team of experts, who either founded or joined the firm on the basis of insights into their target audiences.

People and systems are great sources of information. Although an individual expert’s opinions might hold limited value, a team of experts’ insights will likely generate more information you can use to make crucial decisions. For this reason, savvy firms routinely survey their client-facing teams about issues that their prospective and current clients raise.

You can also mine your financial management system for valuable insights like clients’ average project size or payment histories. You can do the same with your CRM system for data on time-to-close or closing percentage. But even such sources of direct experience data have their limits, as they yield information on only a fraction of your broader market and on past activities and events. They say little about what’s possible. Nevertheless, they are a good starting point and can uncover areas to probe further.

2. Secondary research. This method involves a review of research conducted by third parties. A good place to start is an online search for studies published by industry associations, government agencies and renowned private sector firms. All provide an assortment of free and paid resources across major industries. Other sources you can access online are rating sites, social media, analysts’ reports and industry growth projections.

One popular approach is to license research for your internal use. This works particularly well if the research is of inherent interest to your target group. A number of firms license Hinge’s research when trying to reach professional service firms. However, licensed research will not always get you the information you are looking for.

The internet provides a trove of information on industries and their key issues. Unfortunately, like licensed research, few articles, studies or reports provide the details most firms need on their market segments, nor do they address specific questions to which firms need answers.

3. Primary research. Primary or original research is how you close the information gap. You decide the market segment, and what information to collect. It is also the best way to find out how your target market views your firm and what messaging will resonate the best with them.

Primary research is best done by a third party who can bring to the table expertise, capabilities and independence. Third-party researchers with expertise in your industry can put results in context, which is crucial to providing relevant insights. They also have the right tools to gather and analyze qualitative and quantitative data which, combined with their industry expertise, will ensure the reliability of your research results and the quality of the research report itself. Their independence is important; respondents will likely be more forthcoming if they know their feedback will remain confidential, reducing the risk of response bias.

The most popular primary research methods include structured interviews, focus groups and surveys. Focus groups are often ill-suited to professional services firms, since most executives will limit disclosures in the company of their direct competitors. Fortunately, individual interviews and surveys are good options — and both have their strengths and limitations.

No matter what method you use, primary research expertly done creates value for the firm and its clients. It gives the firm information they need to deliver better, more relevant service; offers opportunities for licensing content; and positions the firm strongly in a crowded, undifferentiated marketplace.

While primary research helps firms create value for the business, it comes at a price. But with the right approach and expertise, the dividends will far outweigh the costs in the near term and the long term. If there’s anything we can learn from those firms that grew three times as fast as the rest and were twice as profitable, it’s that target market research is king.