Under normal circumstances, accountants anecdotally experience very high levels of stress, especially during key times of year depending on their focus: tax season, month-end close, or the end of a fiscal year. But 2020 is testing the profession’s resiliency like nothing has before, and accountants are losing sleep, skipping vacations, and working longer hours to adapt to the challenges the COVID-19 pandemic has brought. One of the places they have turned for relief is technology — technology that has been on the rise in recent years, but is on the fast-track for adoption now.

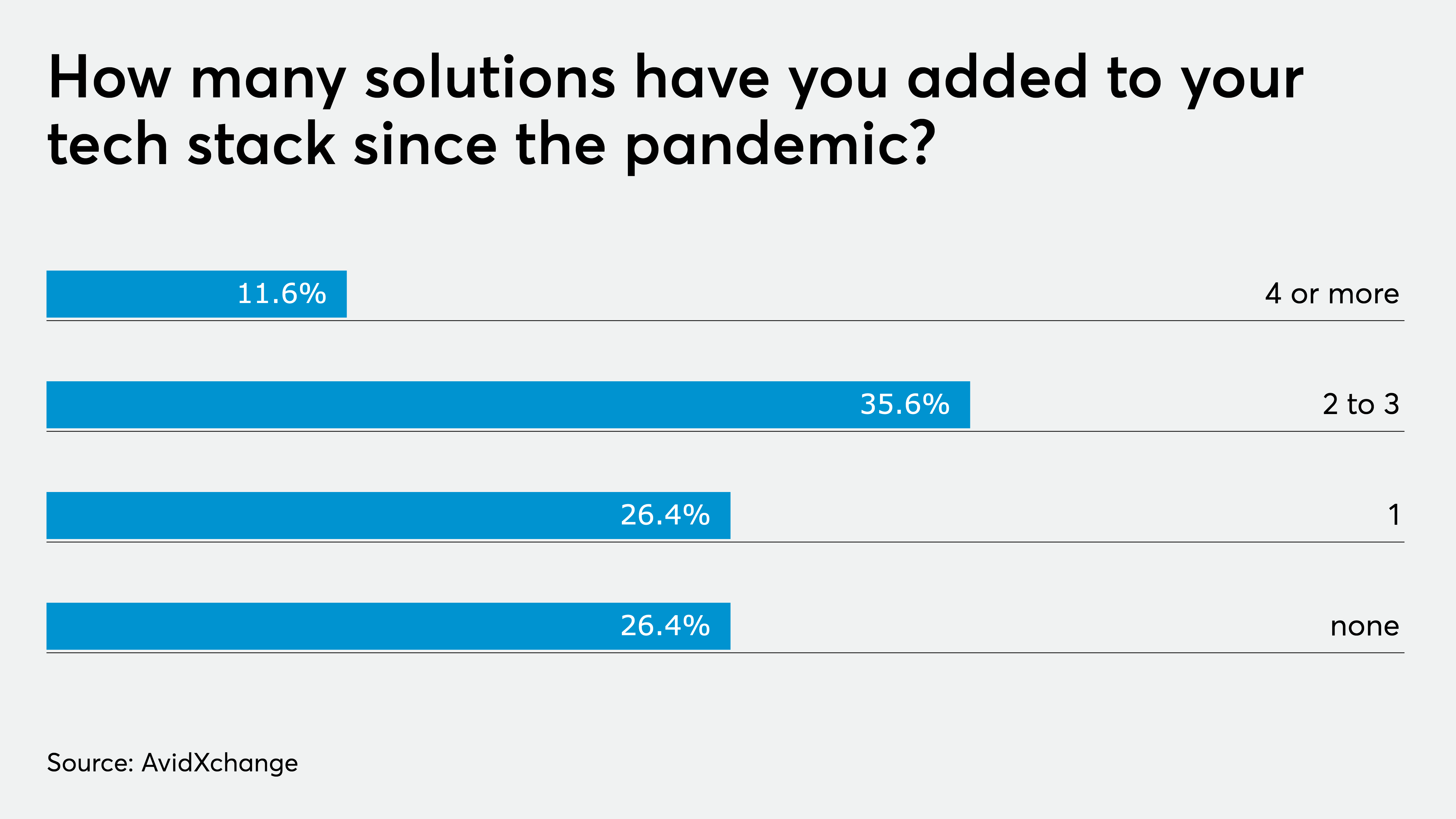

A recent survey, conducted by AvidXchange, has shown that three out of four accountants have added at least one new solution to their technology stack in response to the pandemic. With that in mind, accountants have identified artificial intelligence and machine learning, real-time payments, and generally increased automation as the top three technologies that will impact the business-finance ecosystem the most this year.

AI has been in the spotlight in recent years, as the technology has matured enough to be demonstrably useful to accounting functions such as audit, and any other area that requires data analysis. But like technologies that enable remote work, AI is now on the fast-track for adoption as accountants are forced to find ways to be more efficient as they serve clients struggling with immediate and urgent needs due to business disruption. In effect, AI works as a high level of automation, which is of course key for increased efficiency.

“The sheer workload prompted by the pandemic is overwhelming,” AvidXchange CFO Joel Wilhite said. “People are overcompensating for disruption, and the survey results proved this out. Accountants are working over and above their function, and the accounting and finance world is being stressed further. This may have to do with an absence of automation, but there could be other factors too.”

Tech on the fast track

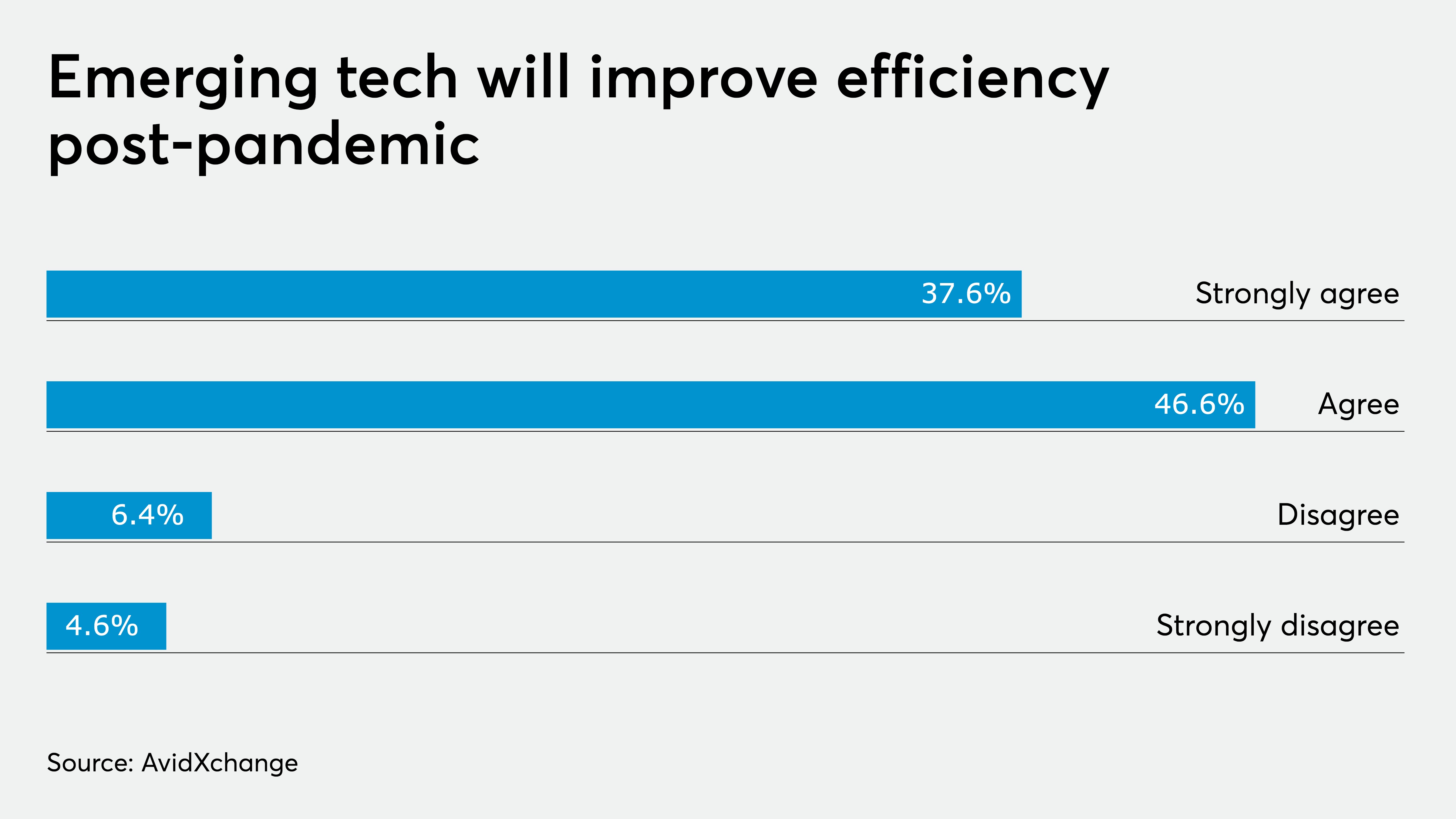

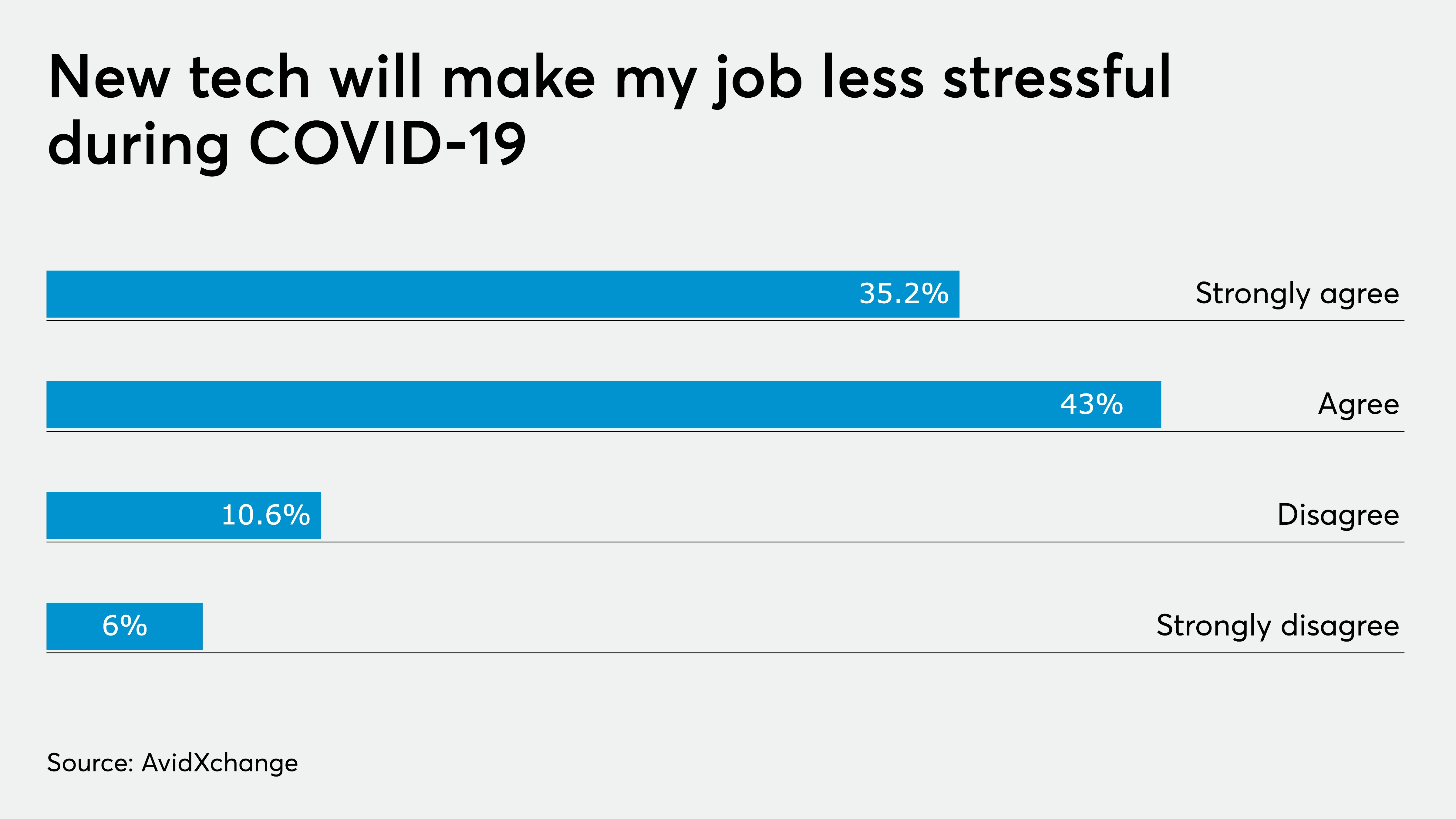

Almost 80 percent of survey respondents said that new technology would make their job less stressful during the pandemic. If the necessity of cloud technology wasn’t clear enough before, it is now. No one can do their work in the current environment without access to information remotely, which the cloud enables. What’s also important is the security of that remotely accessible information, and passing information back and forth on paper is far less secure than accessing information via cloud accounting platforms.

Audit during the pandemic has proven especially difficult, as accountants depend on information from clients whose systems they can’t necessarily control. The American Institute of CPAs has recommended using mail delivery services when necessary to make sure a proper audit is conducted despite the impossibility of in-person meetings. If that seems archaic, it is, but only by necessity. The profession has been working towards a dramatic shift in audit, the AICPA leading the way with its Dynamic Audit Solution, but COVID-19 beat audit to the punch, leaving auditors scrambling to complete their work without the benefit of smoothly functioning, universally integrated information exchange systems.

Business continuity

Most accountants — almost 60 percent — said they had to reevaluate or add to their existing disaster preparedness plan after experiencing the effects of the pandemic. More than 16 percent had no plan in place at all prior to this year. Disasters like hurricanes and floods are usually central to firms’ preparedness plans, and so firms in regions that are affected by such natural disasters usually have plans in place to go remote quickly. But the global nature of the pandemic has made clear how important it is for every firm, no matter what region or size, to be ready to do their work outside their office at a moment’s notice. This includes making sure that data is safely stored and accessible off-site, such as through a cloud hosting provider or by having all data on online solutions as opposed to on-premise.

“I ran finance and acct teams in the pre-cloud era,” Wilhite said. “Business continuity plans included things like who’s going to carry home the printer, and who’s going to take home the check card stock? I did this in a coastal area where we prepped for hurricanes every year. The reality is there is no plan that works well if you’re dependent on retrieving paper and ensuring that paper gets out.”

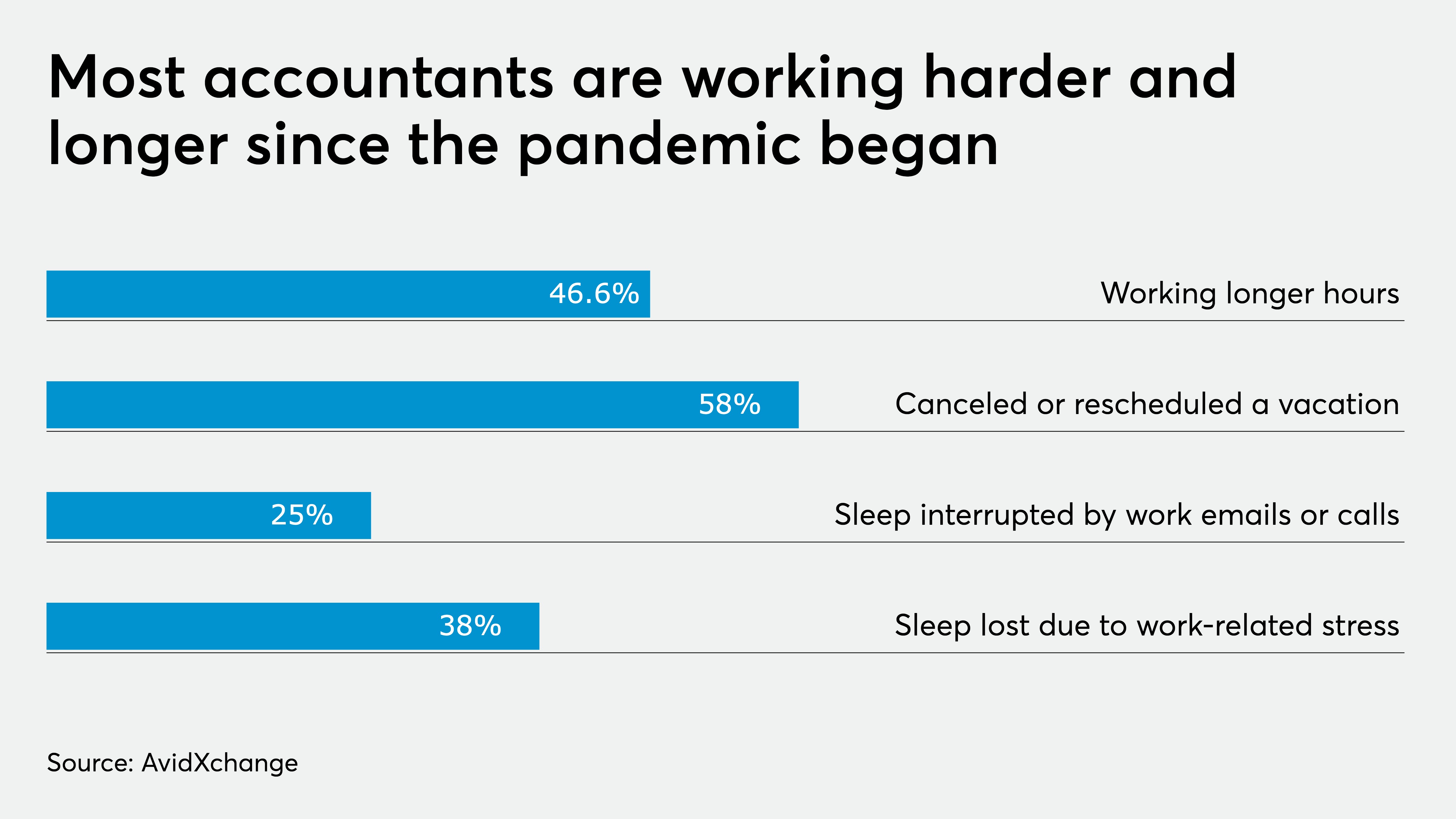

Accountants aren’t sleeping

Likely in part due to the realization that they were underprepared, and the scramble to add new technology to remedy this, accountants are stressed-out and underrested during this pandemic. Almost half the respondents to the survey said they have been working longer hours, and more than half said they had canceled or rescheduled a vacation. A quarter said their sleep has been interrupted by work calls and emails, and more than a third said they have lost sleep purely from stress.

Accountants are no strangers to stress, but the repercussions of this pandemic will go far beyond the acceleration of tech adoption and a new approach to serving clients. Postponing sleep and time off indefinitely is unsustainable. The profession should now be preparing for what the echo-effects of COVID-19 will be in 2021, 2022 and beyond, whether by implementing new technology, recruiting staff equipped to handle the unique challenges of their disrupted clients, or other means.