Senate and House Republicans introduced legislation that would give businesses refundable tax credits against payroll taxes to meet some of the expenses associated with reopening during the novel coronavirus pandemic.

Sen. Rob Portman, R-Ohio, introduced the Healthy Workplaces Tax Credit Act on Monday to help businesses safely reopen while ensuring the safety of employees and consumers through a refundable tax credit against payroll taxes for 50 percent of the costs incurred by a business for increased testing, personal protective equipment, disinfecting, extra cleaning and reconfiguring work spaces to adhere to social distancing guidelines.

Lawmakers are meeting in Washington, D.C., this week to consider another round of coronavirus relief legislation, which is expected to be the last package approved before the election. The tax credits could be a part of it if Democrats and Republicans can agree on a package and get the blessing of President Trump.

The proposed Healthy Workplaces Tax Credit would be limited to a maximum of $1,000 per employee for a business’s first 500 employees, $750 per employee for the next 500 employees, and $500 for each employee thereafter in recognition of the disproportionate impacts of COVID-19 on small- and medium-sized businesses. The bill would encourage and enable businesses to take the recommended steps to prevent the spread of COVID-19 in their workplaces.

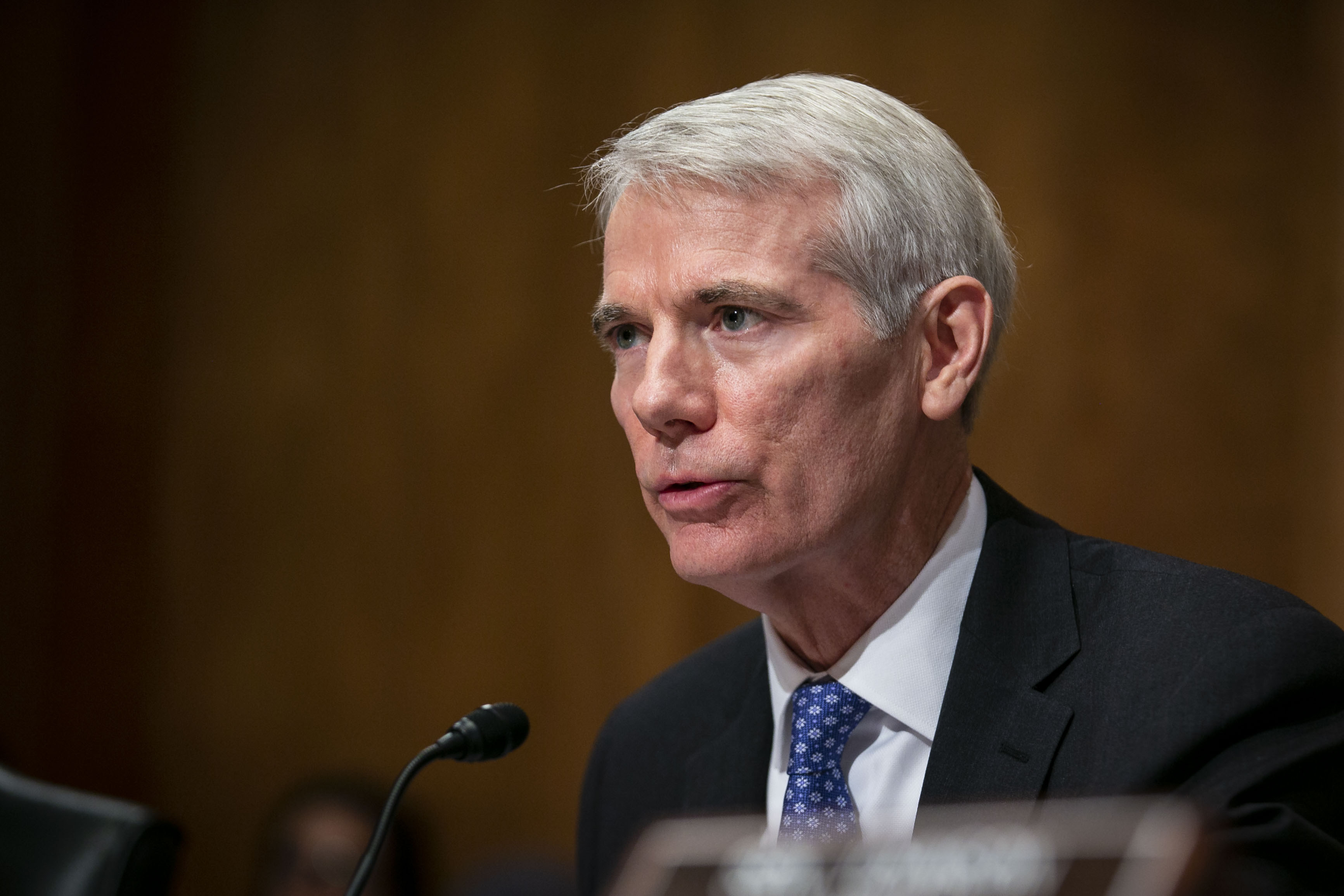

“As businesses in Ohio and across America continue reopening and welcoming back employees and consumers, we must ensure the safety and security of everyone involved by incentivizing steps to prevent the spread of COVID-19 in the workplace through a tax credit,” Portman (pictured) said in a statement Monday. “That’s why I’ve introduced the Healthy Workplaces Tax Credit Act to provide a refundable payroll tax credit to cover 50 percent of the costs incurred by businesses for increased PPE, cleaning, reconfiguring workspaces, and diagnostic testing. A successful reopening of our economy is dependent on both employees and consumers feeling comfortable going back and this tax credit will help make that happen. I urge my colleagues to join me in supporting this tax credit to ensure the successful reopening of our economy.”

Rep. Tom Rice, R-S.C., introduced companion legislation in the House last week. “The coronavirus pandemic is impacting every American,” Rice said in a statement. “As we continue to safely reopen, business owners will have to take unprecedented measures to protect their employees and patrons. Keeping Americans safe while getting back to work is a top priority. It’s important we reconnect workers to jobs and prevent more business closures. Our healthy workplace tax credit will support businesses as they reopen by incentivizing them to take extra precautions to protect the health of patrons and employees.”

One of Rice’s colleagues, Rep. David Schweikert, R-Ariz., also introduced legislation last week paired with that bill to provide a Workplace Testing Tax Credit. It would give businesses a refundable payroll tax credit based on their average number of employees, capping the credit between $250 and $500 per employee depending on the size of the business. It would cover 50 percent of the COVID-19 testing costs for companies working to support and maintain a healthy payroll.

“As businesses in Arizona and across the nation continue to face the ongoing challenges presented by COVID-19, it is critical for Congress to pass legislation that will ease the burden on business owners providing testing for their employees in order to support their health and safety,” Schweikert said in a statement. “This tax credit will empower businesses to make expansive testing of their employees possible while helping to support a healthy labor force. Giving our businesses the tools they need to prioritize health and safety in the workplace will allow them to continue to grow and support our economy during these challenging times.”