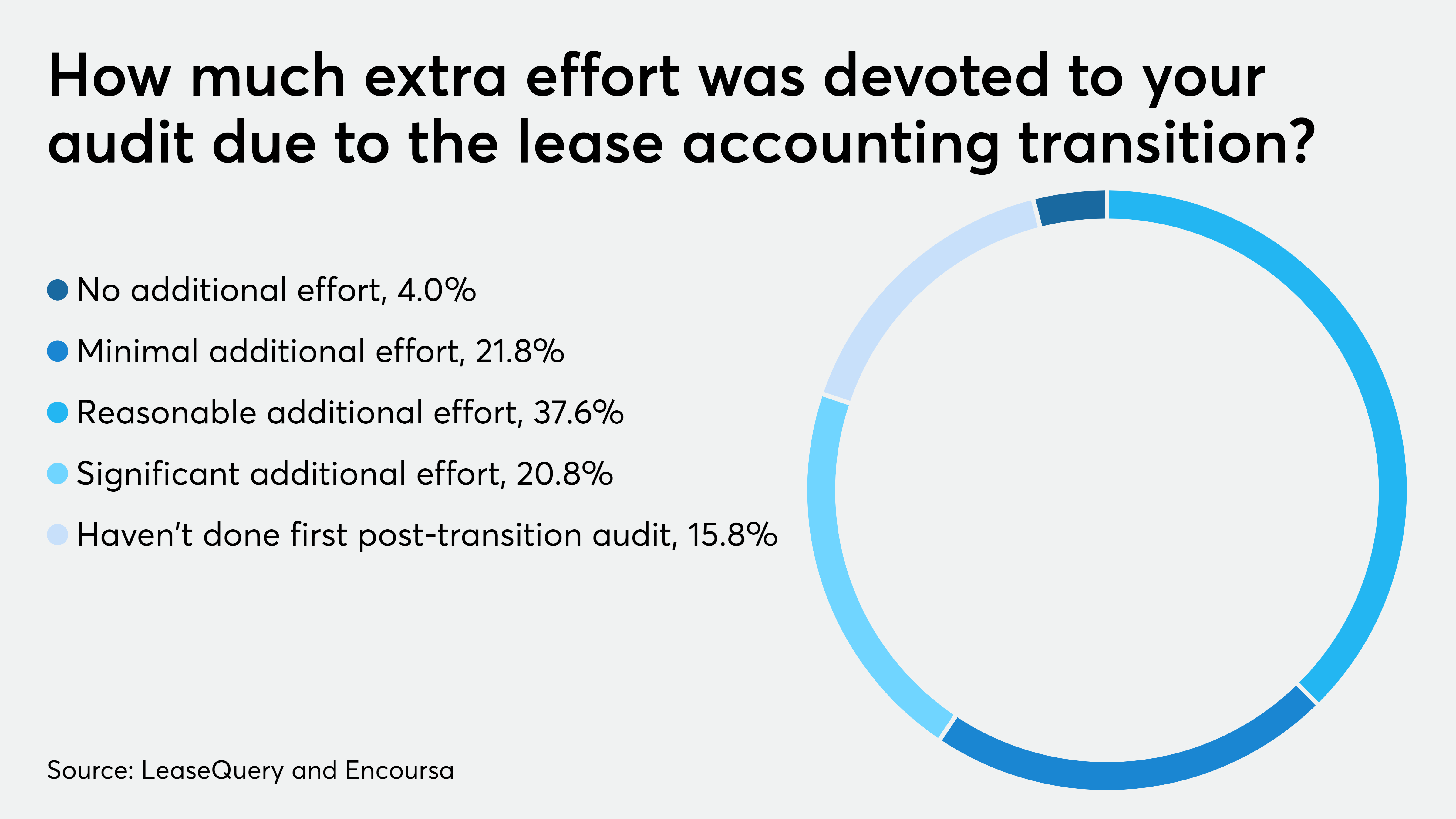

More than half the companies that completed their first audits under the new lease accounting standard needed to make an extra effort, according to a new survey, but the additional work provided more transparency and helped the companies deal with the unexpected crisis of the novel coronavirus, which led to many lease modifications and rent concessions.

The survey, by lease accounting software developer LeaseQuery and CPE provider Encoursa, found that the Financial Accounting Standards Board’s new leases standard, also known as ASC 842, was a challenge during the post-transition audit process. The 240 accountants polled said they identified more cash flow opportunities and enhanced data transparency thanks to the new standard. More than half of the public companies polled (58 percent) discovered embedded leases during their post-transition audit preparation, and 26 percent updated their internal controls for lease terminations and modifications.

The new lease standard puts operating leases on the balance sheet for the first time for many companies. It took effect for public companies at the beginning of last year. It was supposed to take effect this year for private companies and nonprofit organizations, but in response to the COVID-19 pandemic, FASB delayed the effective date for another year (see story). For them, the new standard applies to fiscal years starting after Dec. 15, 2021, and to interim periods within fiscal years beginning after Dec. 15, 2022. FASB’s sister organization, the Governmental Accounting Standards Board, has similarly delayed the effective date of its leases standard for state and local governments (see story).

The delay will give businesses and nonprofits, and their auditors, more time to do the work of implementing the new standards, and making sure they’re applied properly.

“The study demonstrates that after the transition, there still is a lot of work,” said Jennifer Booth, vice president of accounting at LeaseQuery. “This shows that the first-year audit takes a considerable amount of effort. Then the ongoing Day 2 process is also catching a lot of companies off guard.”

The COVID-19 pandemic threw many companies off their schedules and made it more difficult to implement the new standard and have an auditor check their financials. “This study demonstrates that there is a lot of Day 2 work,” said Booth. “That has been exacerbated further by the pandemic this year. Our study shows that a number of companies were using Excel rather than a lease software tool.”

The survey found 50 percent of the respondents leveraged lease software to prepare for and complete the audit, while 38 percent used Excel or another spreadsheet program. Those who originally thought Excel would do the trick for minimal lease changes are now facing difficulties accurately accounting for all those leases that had to be renegotiated due to COVID-19.

“The situation this year has demonstrated that if you have all of your leases in Excel, it can be very difficult to keep track of the changes,” said Booth. “A company typically would have had only one or two changes in a year whenever new leases came on. Then if they’re renegotiating numbers of leases because those assets aren’t being used — as we’re aware that many companies are — all of a sudden, you need to account for all of those changes on your balance sheet. A good lease software solution can either help you to account for those as a modification, or take the FASB’s relief and account for those as a rent concession in the current period. But that’s very difficult if you’re trying to track all of that through Excel.”

In addition to extending the effective date of the new standard, FASB also responded to the COVID-19 crisis by providing guidance on how to account for lease concessions and modifications.

“Back in April they came out with a QA that allows companies to account for these negotiations, these rent concessions, with a lessor in the current period,” said Booth. “The pandemic this year just highlighted what this survey was already showing, which was this Day 2 work is a considerable amount of effort, but it just becomes magnified to have all these changes.”

While two-thirds of the survey respondents said their auditors have full access to the organizations’ lease accounting solution, 44 percent said their auditor had no involvement in the transition process. Only 20 percent of the organizations polled had auditors who set up planning meetings prior to the first audit, and only 18 percent of the surveyed companies reported having auditors who guided them through the lease accounting transition. Fifty-three percent of the private companies and nonprofits polled chose software backed by a SOC (service organization control) report, which can reduce the testing needed to be performed by the company and its auditors to complete an audit.

The delay in the effective date of the standard for private companies and nonprofits has been helpful in getting ready for implementation of the new financial reporting requirements. “The relief has been helpful,” said Booth. “I think it’s allowing companies to focus on the business during this period, but also make sure that at the appropriate time in their business they’re able to start getting back to this transition. The data shows that there’s a lot of work to get ready for compliance. That really can be a drain on the business if you’re not prepared for it. If you prepare for it and talk to your auditor upfront, make sure the auditor agrees with all the procedures you’re going through. If not, it can be a bumpy path for both parties.”

So far, with the first batch of financials coming out from public companies, there have been a few surprises, but most companies seem to be in compliance with the new standard, according to Booth. “I haven’t seen any widespread issues,” she said. “I think companies were able to get there for Day 1. But as the study shows, there was a lot of extra work to get through that.”

The main surprise has been the difference in the amounts that financial analysts had estimated would be added to the balance sheet from the leases that now need to be reported.

“There were kind of mixed results this year,” said Booth. “Earlier this year, when the first public companies were releasing their 10-Ks, the presumption had been that the investors had already factored in the changes to the balance sheet with what they were doing with their own analysis in terms of the commitment that they were including in their projections. I think a lot of the investors found out that there were some differences between their modeling and what the companies had been putting on the balance sheet. I think it demonstrated exactly what the FASB’s goal for this effort was in trying to make information transparent for everyone. Instead of the investors having to guess and to model what a company’s obligations are, now this guidance lays it all out in the financial statements. Hopefully it’s much more transparent when you compare between the companies.”

The lease transition doesn’t end with the adoption of the new standard. “It’s a lot of extra work for a company to make sure that they have the controls and processes in place to meet their internal control requirements, especially in a situation like this year,” said Booth.