We often tend to think of change as gradual. And sometimes it is. But think for a moment about tectonic plates … those slow-moving plates under the earth’s surface.

Most of the time, they move slowly. At other times, they press up against each other and the pressure builds and builds until there’s a dramatic tectonic shift … an earthquake. That’s what we’ve all experienced. On the Richter scale, it was off the charts. And the aftershocks will continue to reverberate.

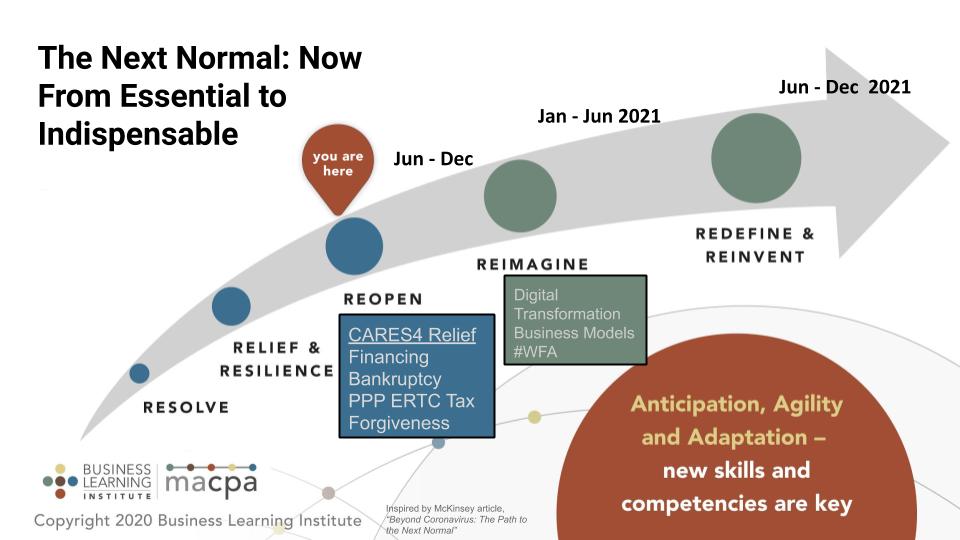

The size, scope and speed of this crisis makes this even more dangerous, which says that imagining a “new normal” seems inadequate. I prefer to use the Mckinsey term recently coined as the “next normal.” This is meant to reframe our thinking and change our paradigms from getting “back to business” to imagining what the “next normal” will be like. It’s part of our quest to make CPAs and finance and accounting professionals #FutureReady, to see further than their competition, and to be aware, predictive, and adaptive of future trends and issues that seem to accelerate with each passing day.

With all that’s happened — with all that’s still happening — many CPAs and finance and accounting professionals are busier than ever.

But if we’re not careful, if we don’t manage to look ahead and devise the right long-term strategies for success, there’s a real risk for us and our organizations to busy ourselves out of business.

Inspired by a recent McKinsey’s article titled “Beyond coronavirus: The path to the next normal,” we think there are five distinct stages we must navigate to get through the COVID storm — resolve, relief/resilience, reopen, reimagine, and redefine/reinvent. We also believe that three new skills — anticipation, agility, and adaptation — will dominate our ability to navigate these turbulent times.

Let’s talk about these stages in detail:

1. Resolve. The shock of this “black swan” event was immediate and severe as the federal and state governments shut down the economy like flipping a giant switch. McKinsey describes this stage as “safeguarding our lives and our livelihood.” Leaders were immediately called on to exhibit perseverance and resolve to calm their stakeholders’ growing fears and preserve their organizations in the midst of massive uncertainty. Accounting and finance professionals were quickly deemed “essential” workers and were allowed to return to work on a limited basis to keep businesses and the economy moving. The big question was how long this stage would last, and we all stayed glued to nightly briefings from the White House and state governors for answers.

2. Relief and resilience. After the initial shock of the massive shelter-in-place orders, it became clear this would not be a short-term event. Governors walked us through the hard realities, with initial predictions that it would take two weeks to “flatten the curve.” Two weeks became four, and four weeks became eight, and the number of confirmed cases continued to rise as businesses began adjusting to the harsh reality of an extended shutdown. Layoffs grew, and the president and Congress began to talk about relief packages. All of these packages ran through the accounting, tax, and payroll systems, underscoring that the profession is “essential” infrastructure for the country’s economic well-being. Leaders and organizations were tested for their ability to survive, and cash was — and still is — king.

CPAs were critical in helping businesses and their clients quickly navigate massive new legislation and regulations that were changing daily. While doctors and nurses were on the frontlines of the health crisis, CPAs and other accounting and finance professionals were on the frontlines of the financial crisis, protecting our lives and livelihoods. The money began to flow from federal and state relief and stimulus programs and many businesses were able to survive, though some did not.

3. Reopen. Most of us are now in some part of the reopening phase and businesses are being challenged as the pace of return varies from countries to states to local jurisdictions. Adding to the complexity are accelerating hard trends that were already in motion before the pandemic hit: Cloud computing, e-commerce, visual/video conferencing, big data, artificial intelligence, cyber-security, and robotic process automation are just a few of those technologies accelerating businesses adaptation to the pandemic. Digital transformation and customer and employee experience should be top of mind as you plan your return strategy. Of course, the most important issue is the health of your team, your customers, and your company or firm.

4. Reimagine. McKinsey says, “A shock of this scale will create a discontinuous shift in the preferences and expectations of individuals as citizens, as employees, and as consumers. These shifts and their impact on how we live, how we work, and how we use technology will emerge more clearly over the coming weeks and months.”

As we look back, we can see more clearly how we adapted to the initial shock of the pandemic. Now it is time to look forward and reimagine what lies ahead post-pandemic. Major parts of business operations like supply chains, a new distributed workforce, contactless commerce, and the need for continued digital transformation will require us to anticipate how these trends will impact our organizations to seek new opportunities for us and our clients.

Next is to lead the creation of a new vision for the future and to mobilize the consent of others as you see through the fog of uncertainty. This is what we mean to be future-ready — “to have the capability to anticipate the hard trends and take action with strategic intent and purpose in order to adapt quickly and thrive.”

5. Redefine and reinvent. In this phase, we will be ready to put into practice many of the key learnings and experiences we have gained. Understanding the predictable hard trends and visible future allows us to anticipate the massive social, health and government changes to come, as well as the continued march of exponential advances in technology. We can expect significant changes in almost every structure we knew before the pandemic, including taxes and regulations in almost every industry. Some will become permanent and some will fade away. The leaders’ job will be to continue shaping their organizations through a constant iteration of redefining and reinventing their context as the pandemic fog clears. And of course, there is a risk of a recurrence that could thrust us back to the reopen phase … or earlier.

From ‘essential’ to ‘indispensable’

In a COVID-19 world, phrases like “new normal” and “next normal” are well worn and overused, to the point of becoming clichès. But there’s a reason why phrases become clichès: There’s an element of truth to them that attracts people over and over again.

We are entering uncharted territory. A new world is upon us. Those who conquer it will be those who reimagine, redefine, and reinvent not only themselves and their businesses, but what it means to live and work in a post-pandemic world. This presents an amazing opportunity for our profession to play an important role helping to shape this future with insight and integrity. This is our chance to move from being “essential” to “indispensable,” to step out from behind the spreadsheets, reports, and forms to be the “most trusted advisor” that the next normal will require. Our millions of businesses from Main Street to Wall Street need us more than ever. This is our opportunity to make this our defining moment!