Small business employment and hours worked grew a bit in September, especially in the Northeast and within the construction industry, according to the latest monthly report from payroll giant Paychex.

The Paychex | IHS Markit Small Business Employment Watch, released Tuesday, indicates a slight uptick in hiring from the previous month, rising 0.06 percent nationally and 0.36 percent in the Northeast from Aug. 14 through the Sept. 17 cutoff date. However, the national jobs index stands at 94.44, roughly in line with April’s reading of 94.63. Growth in weekly hours worked kept up a solid pace, increasing 0.65 percent from last year. Weekly earnings growth held steady at 3.86 percent in September. On the other hand, small business wage growth slowed to 3.14 percent in September.

“For the first time since May, we actually saw the index tick up a little bit, which is good news to see,” said Frank Fiorille, vice president of risk management, compliance and data analytics at Paychex. “Not that there are a robust number of new jobs being added, but existing businesses have been able to hold on and bring them back more for their existing employees, which is driving the rate up a little bit. Again it’s a small increase, but it is an increase and a change in the trend a little bit. It’s the first time we’ve seen an uptick this summer.”

The Northeast region experienced its largest one-month gain in job growth since 2019, up 0.36 percent in September. However, job growth in the West slowed 0.35 percent in September and 1.05 percent in the past quarter, ranking in last place among the different regions of the country. New Jersey has improved each month since dropping off in April, while neighboring New York State has also picked up the pace of job growth in recent months. The top three states for employment growth — Florida, Missouri and Texas — all experienced improvements in September.

“The headline to me this month is the outperformance in the Northeast,” said Fiorille. “We saw New York, New Jersey and Massachusetts show some really good strength as businesses opened up and some of those jobs headed back in. The West is still relatively weak. The South, even though it’s the strongest, didn’t see much growth compared to the Northeast.”

Construction led the way among all industry sectors in small business employment growth for the fifth month in a row and is down only 1.38 percent from last year’s pace. At 88.85, the leisure and hospitality industry was nearly four points lower than the next weakest industry sector, manufacturing, at 92.80. Leisure and hospitality slowed 0.29 percent in September and 9.19 percent compared to last September in terms of employment growth.

“Construction continues to perform really well from a sector perspective,” said Fiorille. “Some of that is due to the housing market being completely on fire right now.”

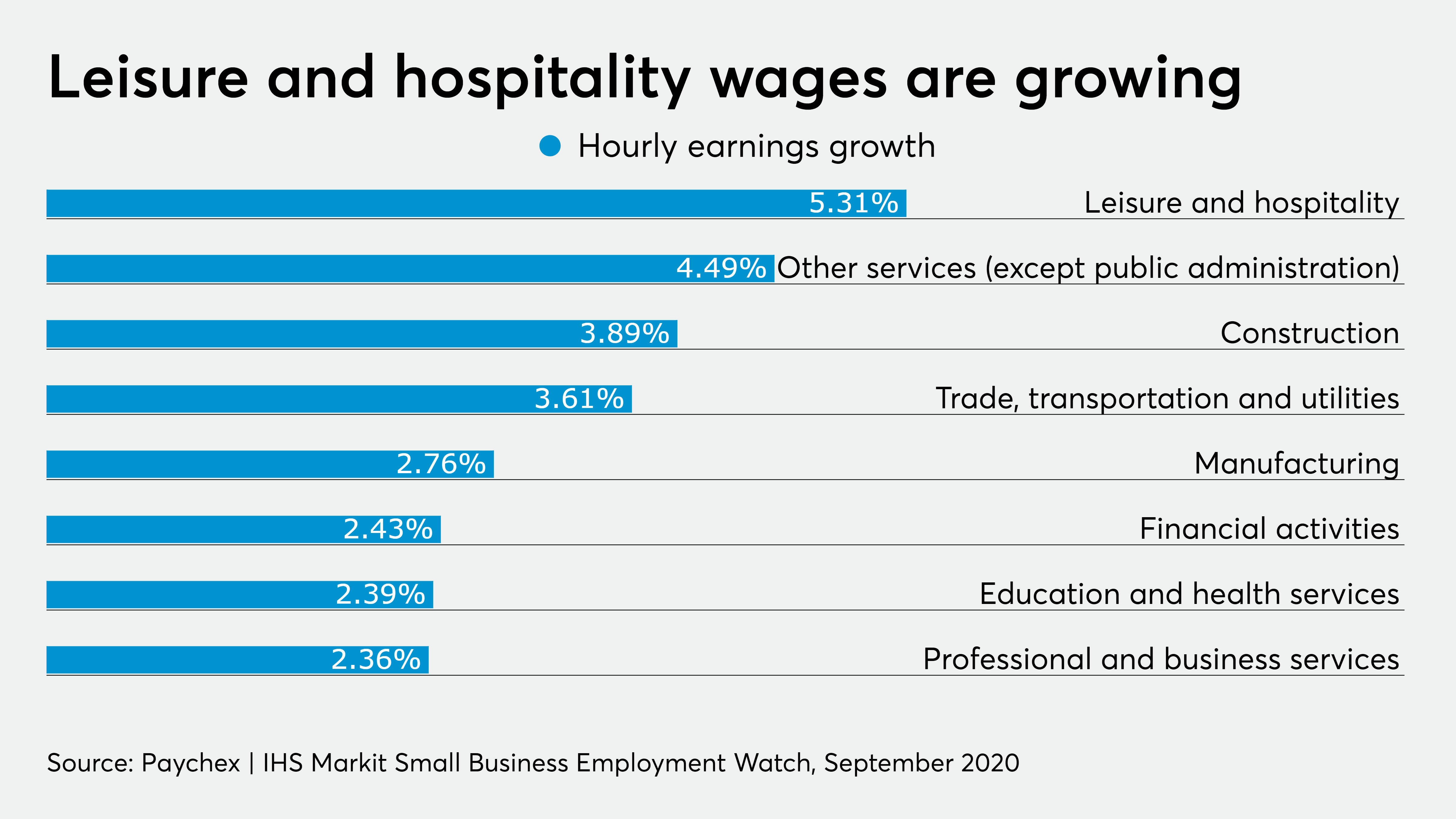

However, in terms of wage growth, at 5.31 percent the leisure and hospitality industry overtook Other Services (except Public Administration), at 4.49 percent, for the sector with the strongest hourly earnings growth in September. Education and health services moved out of last place for hourly earnings growth in September (2.39 percent), with three-month annualized growth of 5.85 percent, pointing to a continued upward trajectory.

The biggest change in the payroll industry this past month was the payroll tax deferral that President Trump called for in his executive action this summer as a way of stimulating the economy. However, with a requirement that businesses and their employees have to repay all of those deferred payroll taxes by April of next year, unless Congress acts to forgive the taxes, Paychex has seen few employers or employees opting to take advantage of the program.

“We’ve got very little interest from our clients to implement that,” said Fiorille. “The last numbers that I saw were extremely small. That is consistent with what we’ve seen from other industry participants, that the interest has been very, very small.”

For accountants and their small business clients, he advises them to keep an eye out for any Paycheck Protection Program loans they may have taken out and be sure to file their PPP loan forgiveness applications with their lenders, even though the U.S. Small Business Administration reportedly has not yet begun to process the loan forgiveness applications.

“If their business took out a PPP loan, they have to get that paperwork in with their lender,” said Fiorille. “Watch for any changes. Even though there’s an easy application for forgiveness, they’re making it even easier. The guidance is not to wait for that. Keep listening and see if there are any changes on that.”

He noted that Paychex has a PPP loan forgiveness estimator that small businesses and their accountants can use in the meantime. Congress may include another round of PPP loans in the next stimulus package, Fiorille noted, but the prospects for that passing before the election are uncertain right now. On Monday, House Democrats unveiled a $2.2 trillion stimulus bill that is a slimmed down version of the HEROES Act bill that they passed in May. The package includes an extension of the PPP deadline. When the program expired in August, more than $130 billion in PPP funding was unused.