Tucked in among more than 5,000 pages of legislative text, the congressional bill providing COVID-19 relief and 2021 government funding includes dozens of tax breaks for beneficiaries ranging from downtown restaurants and the film industry to motor-sports racetracks.

And many of the benefits will stick around long after the pandemic is over. Besides granting temporary tax credits to help businesses cover the cost of payroll, the bill gives benefits for wind and solar projects and creates a permanent tax break for beer brewers, wine makers and liquor distillers.

Also included is a favorite of President Donald Trump: a write-off for wining and dining business clients.

The inclusion of nearly 80 tax-related provisions in the bill represents an age-old strategy in Washington for many lawmakers and the lobbyists who try to influence them: Attach your favorite tax break to a large, must-pass bill where a couple of extra write-offs won’t stop the momentum toward passage.

COVID-19 relief became the vehicle in 2020, with lawmakers rushing to complete an assistance package and wrap it up with regular appropriations for federal agencies to keep them running through next September.

$328 billion

The $2.3 trillion spending bill, released Monday afternoon, is 5,593 pages. The House is expected to vote first, with the Senate planning to take the bill up by day’s end.

The total cost of the tax-break bonanza is $328 billion, according to the Joint Committee on Taxation, Congress’s non-partisan scorekeeper. About half of that amount is for $600 direct checks for many middle and low-income adults, plus additional payments for their children. The other half covers the slew of deductions and credits intended to boost the economy during the pandemic and beyond.

The legislation expands the deduction for business meals — including delivery and carry-out — for 2021 and 2022, a change that Trump has pushed for months and Congress ignored until recently.

Trump, whose business holdings include resorts and golf courses, has plugged an expansion of the measure to let businesses fully write off the costs as a way to help restaurants struggling with the pandemic. Companies up to now can write off 50% of the costs, based on an item included in Trump’s 2017 signature tax cut.

Unrelated measures

Economists have argued that many of the tax breaks would do little immediately to spur economic activity. That’s because most sporting events are closed to fans, concert halls have largely been shuttered amid social distancing guidelines and few businesses are conducting face-to-face meetings with clients.

“If businesses are closed due to the pandemic, this break will do nothing to help them,” said Kyle Pomerleau, a resident fellow at the right-leaning American Enterprise Institute. “The ongoing pandemic makes this particular strategy dangerous. We don’t want people to increase their risk of infection to go to restaurants. This is especially foolish given that a vaccine is so near.”

The food and wine industry is defending the tax break, saying they have been one of the hardest hit sectors and deserve more help.

The “deduction is helpful to businesses operating in uncertainty as to what 2021 will actually shape up to be. It’s absurd to say this will only benefit wealthy Americans or ‘lovers of Vermouth’,” Michael Bilello, a spokesman for the Wine and Spirits Wholesalers of America said. “Every meal in a restaurant means economic activity that benefits the entire restaurant team.”

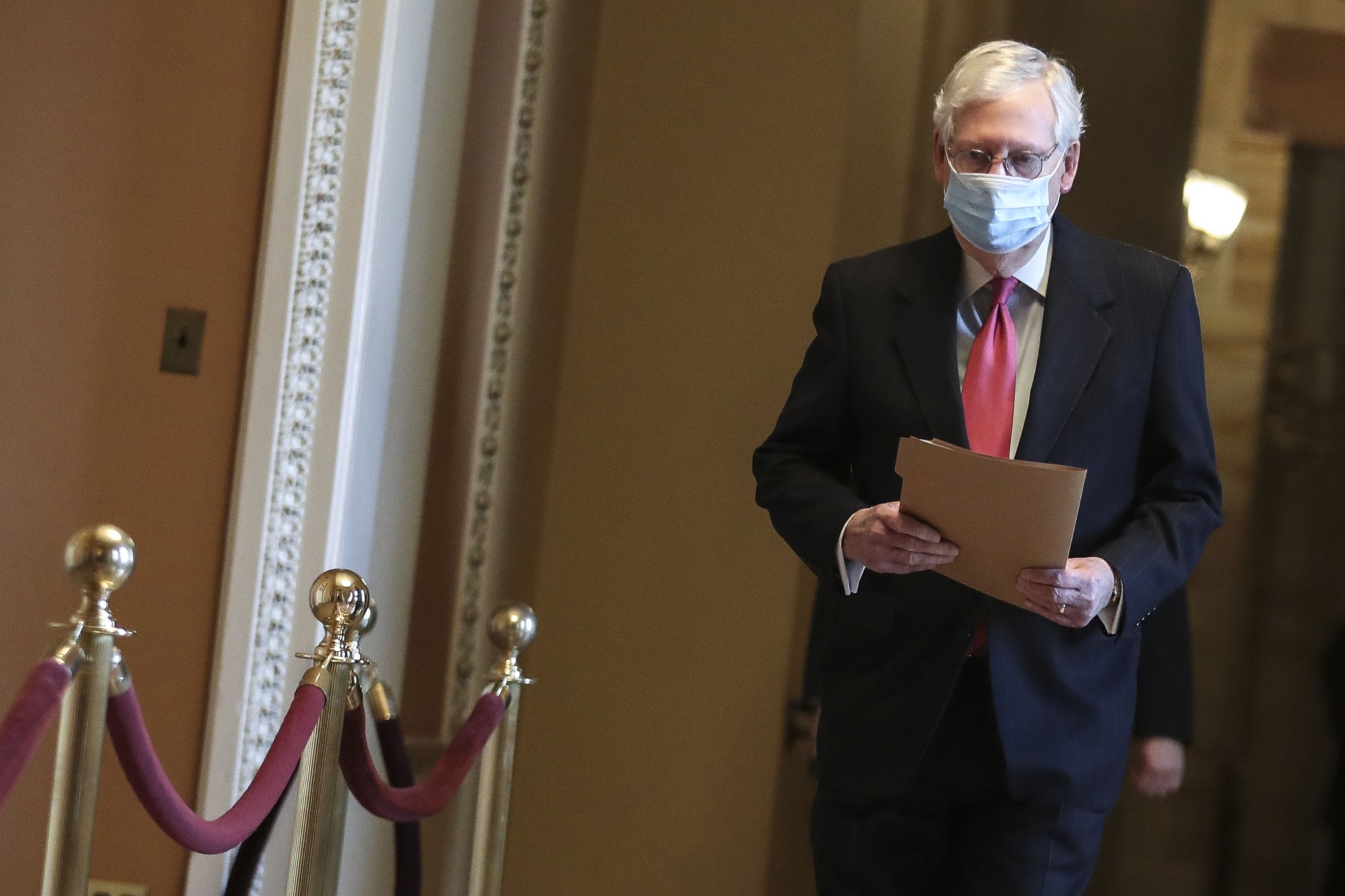

Senate Majority Leader Mitch McConnell also got a tax break important to his home state of Kentucky: special write-offs for race horses.

The legislation also includes a fix lawmakers have been seeking to make for months: a more generous version of the employee-retention tax credit for businesses that keep workers on their payrolls. The break gives companies an additional incentive to keep people employed as many firms still face revenue downturns but have run out of Paycheck Protection Program money or never qualified for it.

Jobs saved

The credit is refundable against payroll tax liability, meaning that companies could get a check back from the IRS if they qualify for a larger tax break than the payroll taxes they owe. However, some are skeptical it will be a huge boon to businesses.

“It certainly has saved some jobs and helped some businesses with cash flow, but not that much on aggregate,” Marc Goldwein, a senior policy director at the Committee for a Responsible Federal Budget, said.

The bill also closes the chapter on a move by Trump last summer to provide stimulus when the administration couldn’t get a deal with Congress.

The president let employers stop withholding their workers’ payroll taxes for the final months of 2020, in the hope of getting Congress to cancel those amounts owed later. The move had limited impact, as most private companies didn’t follow through. Parts of the government and military did stop payroll-tax withholding for employees.

Extended payback

In the end, lawmakers didn’t write off those obligations, although they did extend the payment window. The legislation allows the transfers to be spread out over 12 months, rather than leaving them due April 15.

Elsewhere, the legislation includes a slew of changes intended to boost tax savings for low-income individuals. The bill would let individuals use their 2019 income levels for the earned income tax credit and child tax credit claims, a move that will enlarge their IRS refunds if they saw earnings drop this year.

The legislation also extends an above-the-line tax deduction for charitable gifts — so all taxpayers, not just those who itemize, can get tax breaks for donations. Individuals can write off up to to $300 in gifts and married couples can claim up to $600 in breaks.

The legislation makes permanent several tax breaks that lawmakers have been repeatedly extending for years. Alcohol producers get a permanent excise tax cut. A more generous write-off for medical expenses will be permanently added to the tax code. Benefits for students, volunteer firefighters and medical responders will also get cemented.

Several more — including the benefit for motor-sport racetracks, deductions for film producers and tax breaks for employers to provide paid sick leave and pay for tuition costs — got temporary extensions through the end of 2025. At the end of that year, many of the key provisions in the Republicans’ 2017 tax overhaul are also set to expire — including the individual income tax cuts and special deductions for small businesses.

That’ll set up the potential for a similar massive year-end bill, five years from now.

“In 2025 there is going to be a fiscal cliff,” said Rohit Kumar, a tax adviser at PricewaterhouseCoopers LLP who previously worked for McConnell. “It’s an automatic tax increase of roughly $3 trillion — or $300 billion a year for 10 years. It’ll be a huge deal.”