Organizations lose 5 percent of their revenue to fraud each year, according to a new report from the Association of Certified Fraud Examiners.

The percentage has remained relatively constant over the years, according to the ACFE’s 2020 Report to the Nations. The biannual report analyzes 2,504 cases of real fraud from 125 countries that totaled over $3.6 billion in losses. The typical case of fraud costs $8,300 per month, and the median duration of each fraud case was 14 months.

The median loss per case was $125,000 total, but the overall average loss per case was $1.509 million. The use of anti-fraud controls — including hotlines, anti-fraud policies and training — have increased significantly over the past decade (up to a 13 percent increase for each control).

Forty-three percent of the schemes have been detected by tips, and half of those tips came from employees. There has been a steady decline in organizations pressing criminal charges for fraud, but there has been an increase in them opting for civil litigation against fraudsters.

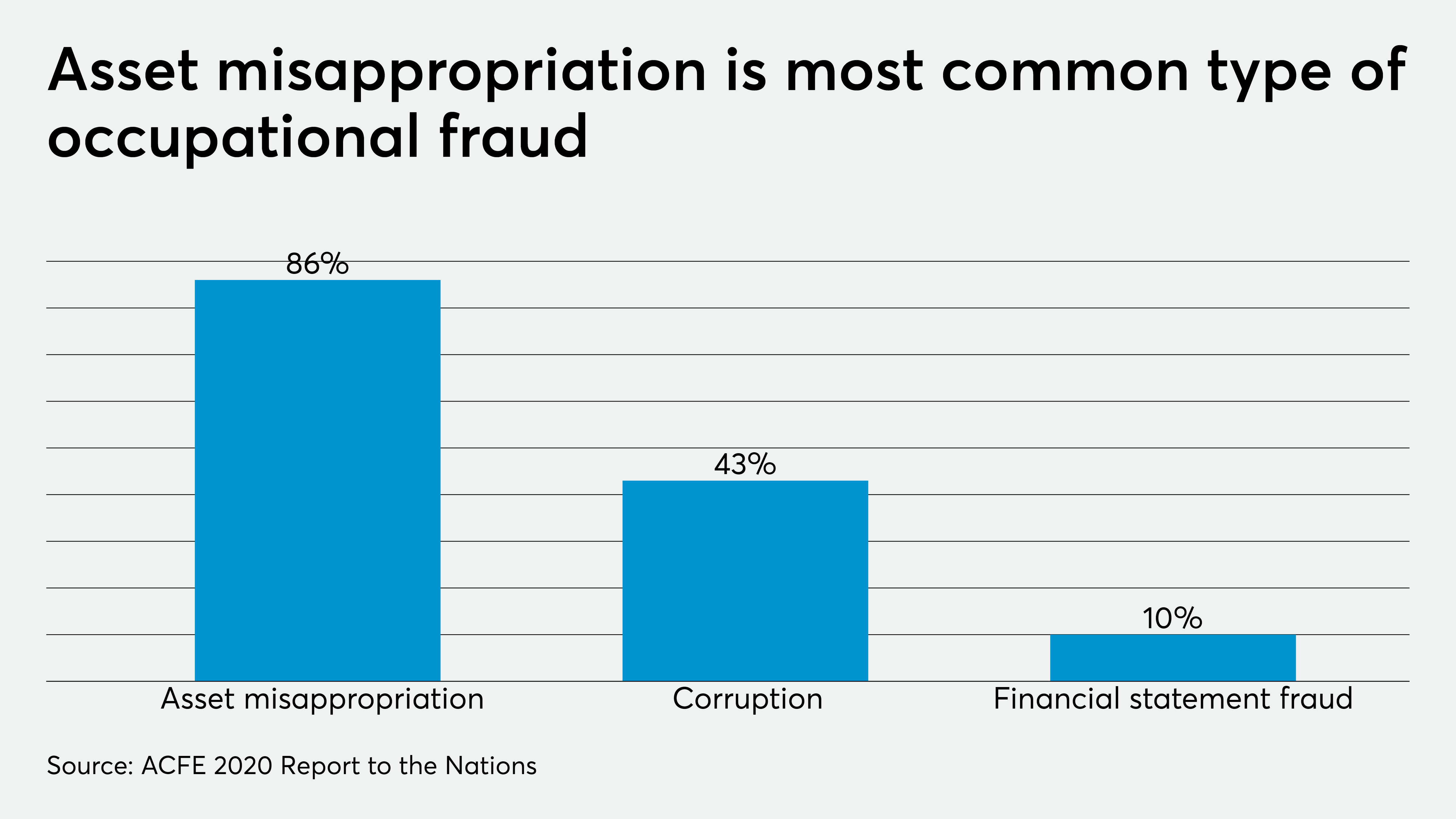

There are three main categories of occupational fraud, according to the report. Asset misappropriation, which involves an employee stealing or misusing the employing organization’s resources, happens in the vast majority (86 percent) of cases, but these schemes also tend to cause the lowest median loss, at $100,000 per case. On the other hand, financial statement fraud schemes, in which the fraudster intentionally causes a material misstatement or omission in the organization’s financial statements, are the least common (10 percent of schemes) but account for the costliest category of occupational fraud. The third category, corruption — which includes bribery, conflicts of interest and extortion — falls in the middle in terms of both frequency and financial damage. Corruption schemes happen in 43 percent of cases and lead to a median loss of $200,000.

“One of the other areas that the ACFE highlights as well as the revenue falsification and revenue recognition is misappropriation of assets,” said Brian Fox, president and founder of Confirmation, a maker of audit confirmation technology. “Misappropriation of assets can be things like inventory, but primarily cash. People aren’t going to steal a John Deere tractor, but they will steal lots of cash.”

In one-third of the cases in the ACFE study, the fraudster committed more than one of the three main categories of occupational fraud, with 26 percent of fraudsters undertaking both asset misappropriation and corruption schemes, while 3 percent misappropriated assets and committed financial statement fraud, 1 percent engaged in both corruption and financial statement fraud, and 5 percent participated in all three categories of occupational fraud.