The Treasury Department and the IRS reported they have delivered 88.1 million coronavirus stimulus payments to individual taxpayers as of April 17, 2020, totalling $158 billion.

More than 150 million of the Economic Impact Payments will also be sent out.

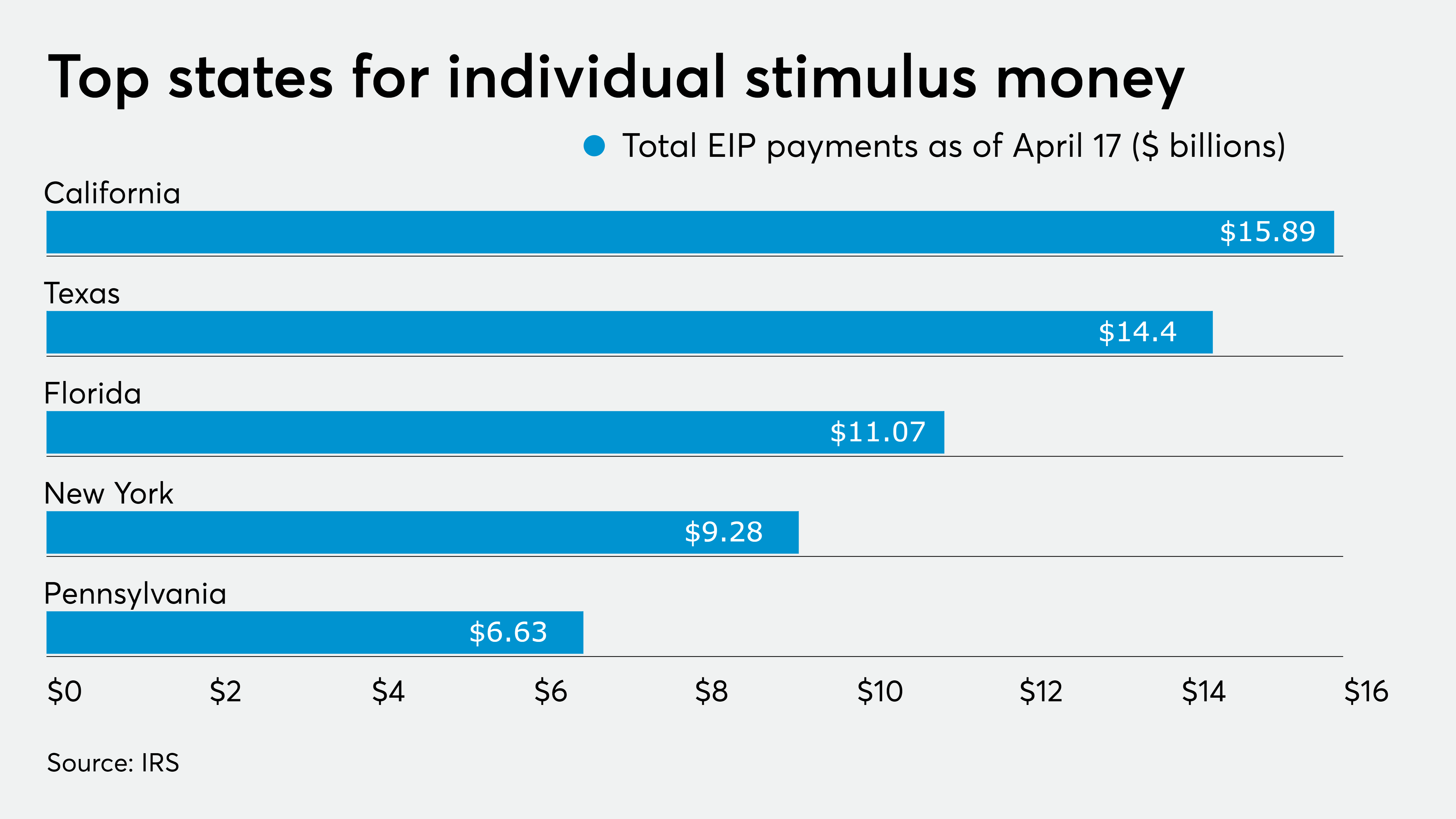

States that have received the most payments and money so far are California, Texas, Florida, New York and Pennsylvania.

States that have received the fewest payments are Wyoming (166,195 payments totaling $316,335,903), the District of Columbia (179,738 payments totaling $255,501,803), Vermont (188,076 payments totaling $332,111,224), Alaska (209,629 payments totaling $384,976,728) and North Dakota (215,321 payments totaling $399,771,434).

Millions who don’t typically file a tax return are eligible to receive the payments. They are automatic for people who filed a tax return in 2018 or 2019, or receive Social Security retirement, survivor or disability benefits and Railroad Retirement benefits, as well as for Supplemental Security Income and Veterans Affairs beneficiaries who didn’t file a return in the last two years.

Individuals are eligible for up to $1,200 each in stimulus payments, while married couples who file jointly could get up to $2,400. Qualifying children under age 17 could also receive $500 each.

The payments have run into some problems since the federal government began distributing them almost two weeks ago, including delays in payment and information about the payments via the IRS tool, and payments mistakenly made to the deceased and to preparers’ accounts.

The Taxpayer Advocate Service has also designed a tool to assist taxpayers with claiming payments. The tool is for taxpayers who know they qualify but haven’t gotten any money, and describes what steps, if any, need to be taken to receive the payment.