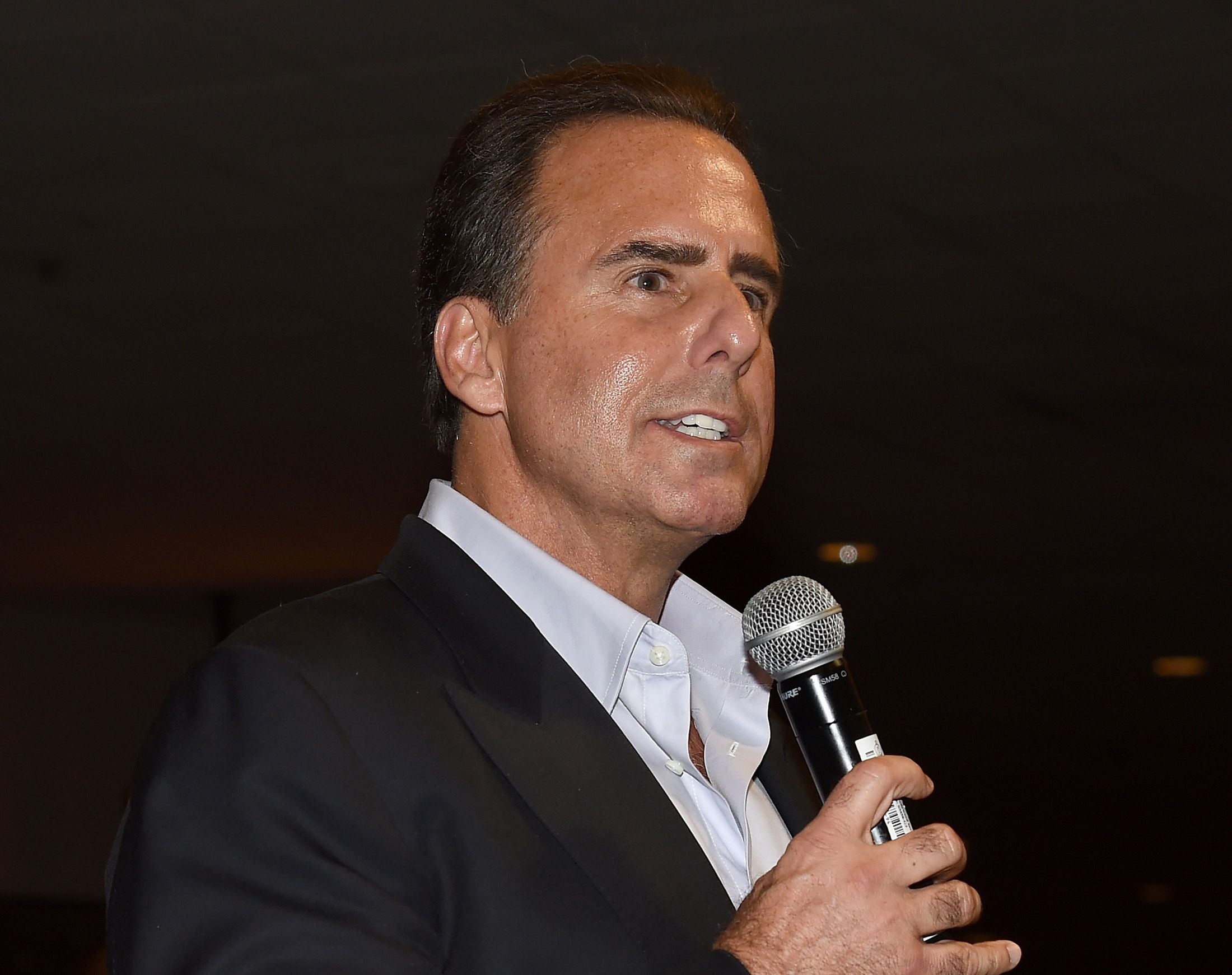

Mark Frissora, the former chairman and chief executive officer of Hertz Global Holdings Inc., will return nearly $2 million in incentive-based compensation to settle a U.S. regulator’s claims that he played a key role in causing the now-bankrupt car-rental company to file inaccurate financial statements in 2013.

Frissora pressured subordinates to “find money,” mainly by re-analyzing reserve accounts, as Hertz’s financial results fell short of forecasts in 2013, the Securities and Exchange Commission said in a statement Thursday. He also kept older cars in the company’s rental fleet longer to lower depreciation costs without disclosing the change to investors, the SEC said.

Hertz reaffirmed earnings guidance in November 2013 despite internal projections that showed lower earnings per share figures, according to the SEC. The company then revised the results in 2014 and restated them in 2015, cutting previously reported pretax income by $235 million, the SEC said. Hertz agreed to pay $16 million to resolve SEC claims over the misstatements.

Frissora, who agreed to settle without admitting or denying the SEC’s claims, will pay a $200,000 fine in addition to returning nearly $2 million in incentive-based pay. He left Hertz in September 2014 after investors pushed for his removal and went on to serve as president of Caesars Entertainment Corp. for four years through April 2019.

Hertz, which filed for bankruptcy in May, said earlier this week that it is seeking debtor-in-possession financing. That came after the SEC raised questions about a plan to issue as much as $500 million of equity, forcing Hertz to terminate the offering after raising just $29 million from investors.