In hockey, it’s the equivalent of moving the red line.

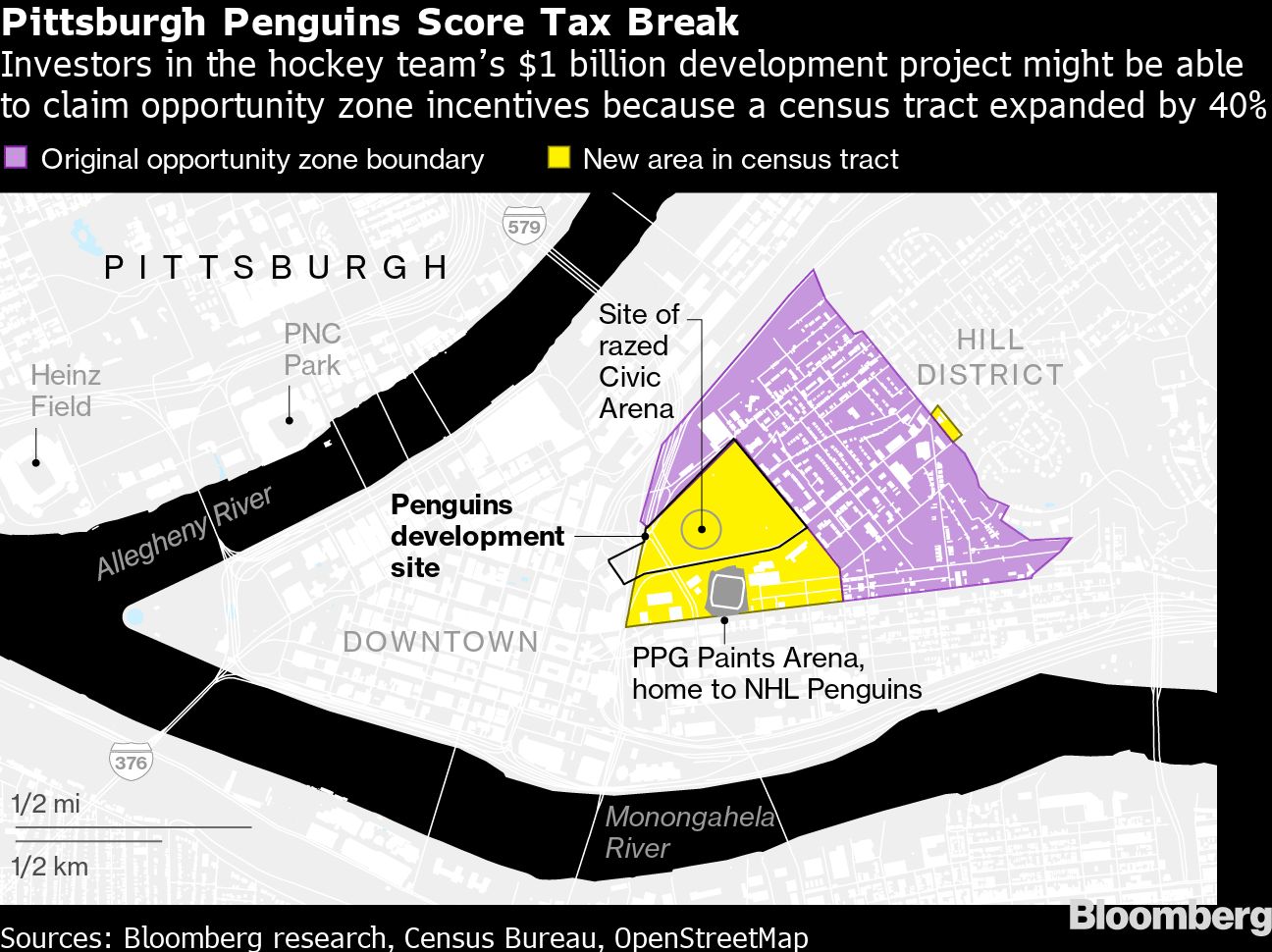

Two years ago, the Pittsburgh Penguins, along with Pennsylvania officials and a union leader, lobbied Donald Trump’s administration to expand an area earmarked for tax incentives so it would include the site where the hockey team is embarking on a $1 billion development project.

The effort paid off. When the U.S. Census Bureau released updated maps this year, the site had been merged into a tract designated an “opportunity zone” under the 2017 tax law. That sets up investors to score generous federal economic development incentives.

Similar maneuvers played out across the country as census tract boundaries were changed to accommodate wealthy investors whose projects fell outside the lines of roughly 8,700 opportunity zones. About 140 tracts grew in size by at least 5 percent, according to census data analyzed by Bloomberg News. Thirty-six expanded by 20 percent or more.

Interviews and documents show that some of these changes followed appeals by developers and their allies to the White House, senior Treasury Department officials and former Commerce Secretary Wilbur Ross, who oversaw the Census Bureau. Although there’s no indication that such talks broke any laws, the lobbying put pressure on the bureau to approve changes that some people involved in the once-a-decade revisions found inappropriate.

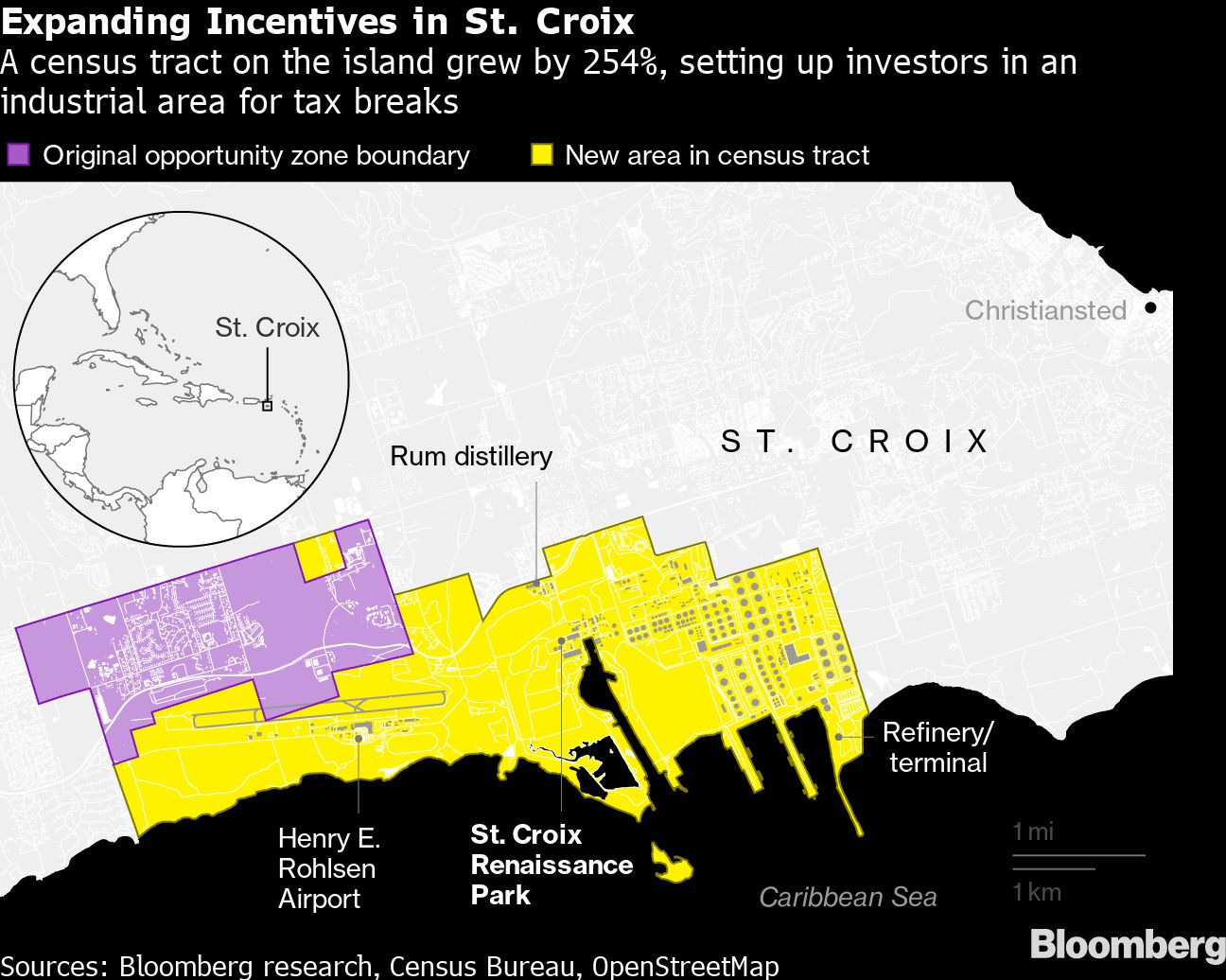

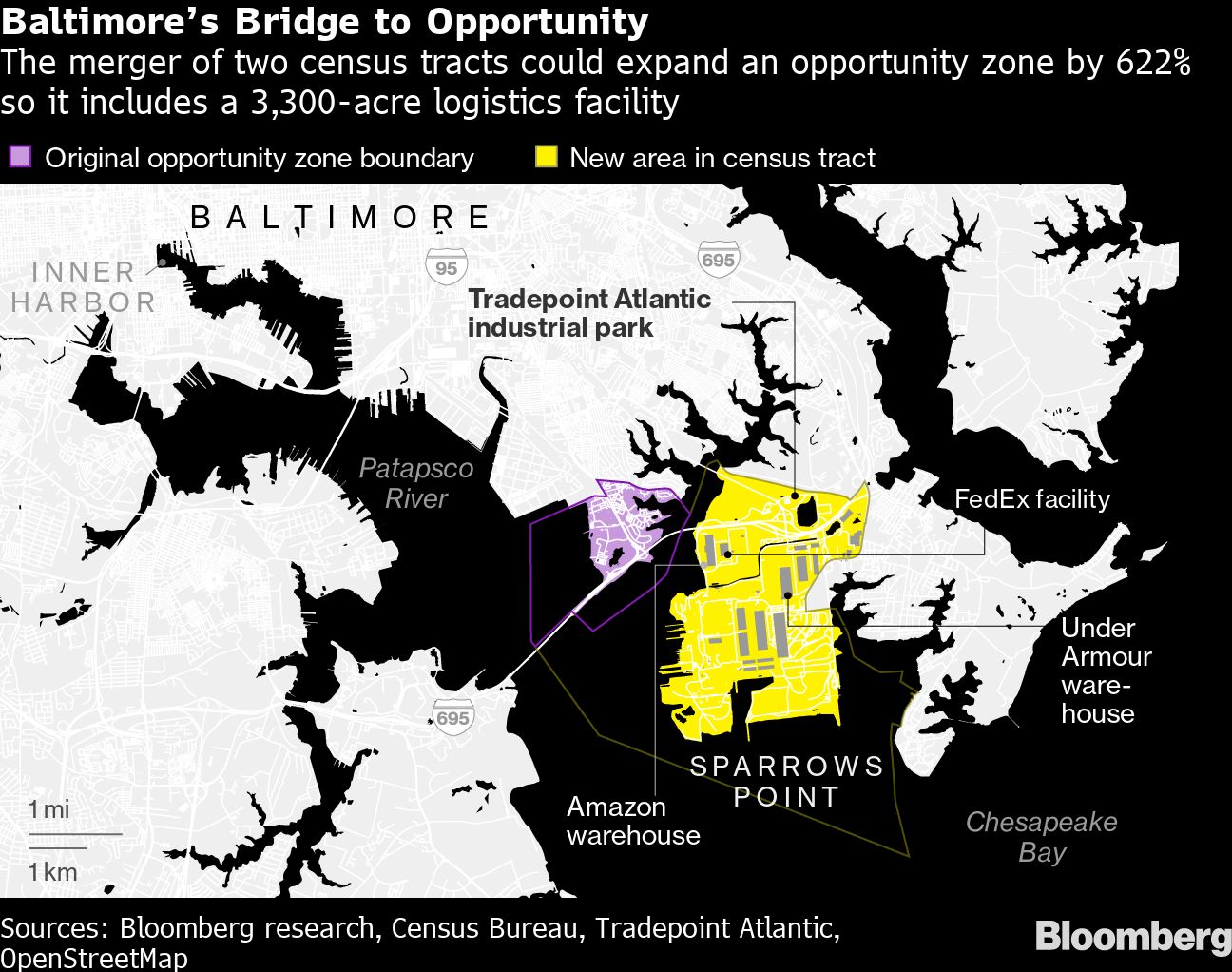

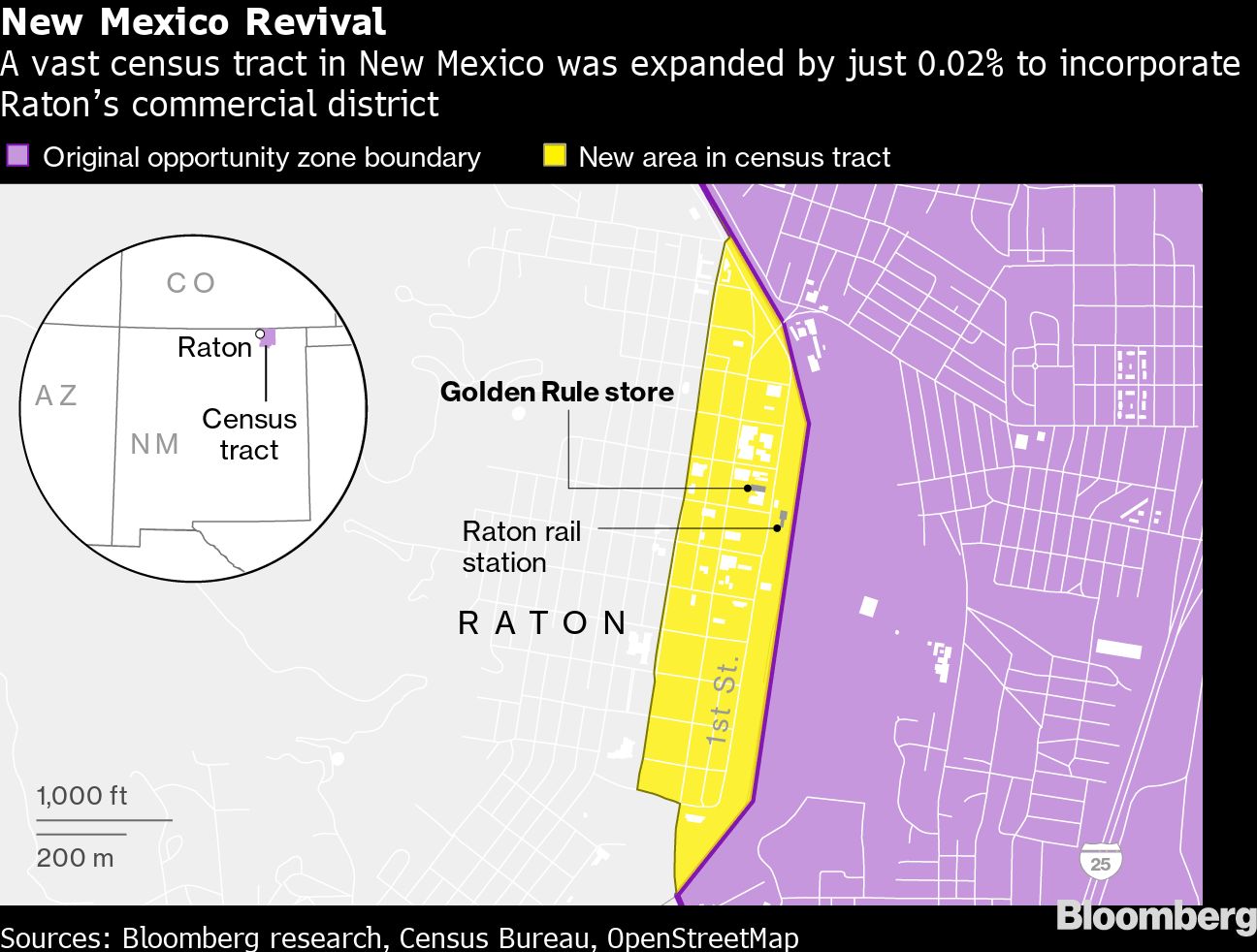

On the tropical island of St. Croix, a U.S. territory, an opportunity zone more than tripled in size after an investor encouraged the local government to lobby for a change. Included in the enlarged area: an airport, an oil refinery and an industrial park with a rum distillery. Near Baltimore, the operator of a 3,300-acre logistics park pushed for a merger with an opportunity zone across a river, potentially allowing tenants such as Amazon.com Inc. and Under Armour Inc. to benefit from the tax breaks. The requests extended to rural Raton, New Mexico, where a city manager asked to move a census tract boundary about 1,000 feet to include a downtown district.

A spokesman for the Census Bureau didn’t comment on a detailed list of questions about the tract changes.

Opportunity zones were among the most innovative and bipartisan features of Trump’s tax overhaul. Investors can claim the incentives by selling an asset that has appreciated in value and plowing the proceeds into projects or businesses in a zone. That lets them defer taxes on capital gains through 2026. If the new asset is held at least a decade, it’s not subject to any capital gains tax when sold.

The benefits were meant to pump money into overlooked communities, but criticisms have piled up. In some cases, politically connected individuals influenced the selection of tracts governors picked for the incentives. Some zones were already attracting investment, so the breaks may just juice returns on projects developers were likely to do anyway. And, because there’s no requirement to help low-income communities, the incentives have been used to finance everything from luxury apartments in Houston to a Ritz-Carlton hotel in Portland, Oregon.

The new census boundaries will likely inflame those frustrations. Tracts are supposed to stay consistent, giving researchers and policymakers a way to make comparisons over the decades. The geography is also used to allocate hundreds of billions of dollars in government spending and is linked to other incentives for economic development that could be affected by the changes. “This is the building block of how we’re delivering social policy,” said Brett Theodos, a senior fellow at the Urban Institute. “Our nation’s map is being redrawn so developers can make more money.”

All this comes at a time when political momentum is building to raise taxes on the wealthy to help support families and small businesses during the pandemic. The question is whether President Joe Biden’s administration will take steps to bar investors from claiming the tax breaks if census tracts were altered to include their properties. The Internal Revenue Service has yet to issue guidance on the matter. Spokespeople for the Treasury and the IRS declined to comment.

Complicating the issue are the coalitions of local and state leaders, unions and other community groups — some pulled together by developers — eager to see the projects succeed in a time of economic fragility. They argue that the changes will help make the policy work as intended, delivering jobs and development to areas that need it.

Few places illustrate this better than Pittsburgh, where the Penguins, co-owned by billionaire Ron Burkle and former hockey star Mario Lemieux, are pitching their development as a way to right past wrongs.

In the 1950s, part of a historically Black neighborhood was razed to make way for the Civic Arena, a silver-domed structure known to Penguins fans as “The Igloo.” The stadium was torn down a decade ago and replaced by a sea of parking lots. Since then, the city has struggled to get development going. In recent years, momentum has coalesced around a 28-acre project that is expected to revitalize the surrounding communities. It includes an office tower, housing and a music venue.

Pennsylvania officials have poured millions of dollars into infrastructure improvements. They were also working with the hockey team, which controls the development rights, to annex the site to an adjacent opportunity zone, according to Penguins Chief Operating Officer Kevin Acklin. In March 2019, Pittsburgh Mayor Bill Peduto wrote to Governor Tom Wolf, asking him to petition the Trump administration to do just that. A month later, the head of the state’s development agency wrote Treasury Secretary Steven Mnuchin requesting the change.

Acklin then met with Mnuchin’s counselor, Dan Kowalski, both men confirmed. Kowalski, who has left the department, said he explained the Census Bureau’s process for updating its maps.

The United Steelworkers union also got involved. Its international president at the time, Leo Gerard, wrote to Commerce Secretary Ross in July 2019. The letter, reviewed by Bloomberg News, said Kowalski and White House officials had advised that a case could be made for tax breaks if the census tract boundaries were changed. Gerard’s letter was shared with the Census Bureau, which studied the matter and approved expanding the nearby opportunity zone tract by almost 40 percent.

Spokespeople for local and union officials said they supported the boundary change because it would bring jobs and money to the neighborhood. “It provided a chance to spur development at a site that has long been challenging but has great promise for the community,” said Timothy McNulty, a spokesman for Mayor Peduto. “It gets the property back on the tax roll and will provide transformative work for hundreds of Black workers in a largely underserved area,” said Jess Kamm Broomell, a spokeswoman for the steelworkers’ union. Ross didn’t respond to email requests for comment.

Acklin, the Penguins’ operations chief, said the project would have moved forward even without the boundary change, which happened after plans for the site were far along. But the incentives mean the development, expected to break ground this year, could get more money flowing to the community. “This is all about utilizing a federal tax break that doesn’t come out of the hide of anyone locally,” said Acklin, who previously served as the mayor’s chief of staff. “It will drive additional capital investment, not just in the site, but in the whole zone.”

The team’s owners don’t plan to use the incentives, Acklin added. But the Buccini/Pollin Group Inc. and Clay Cove Capital, which are working with the Penguins on the first phase of the development, do. “It’s the kindling that gets the fire going,” said Chris Buccini, co-president of the development company.

Still, no one told Marimba Milliones. As chief executive officer of the Hill Community Development Corp., she has been deeply involved with planning for the Civic Arena site, pushing the city, the Penguins and its partners to provide benefits to the neighborhood. She also was active in discussions around opportunity zones, suggesting the governor nominate the tract that ultimately absorbed the site and enact protections to ensure the investment helped community residents.

So it was a surprise to her to learn about the effort to lobby the Trump administration without any study of whether the tax benefits might speed gentrification and push out local residents. “To proceed without that engagement and that analysis is a huge loss,” Milliones said, and it could be a “threat to our long-term ability to preserve this as one of the most historically important Black communities in the nation.”

The reason the Census Bureau even considered the change owes to a process it undertakes every decade to get input on its maps called the Participant Statistical Areas Program. Representatives from regional planning groups, local governments and elsewhere are invited to propose changes that the bureau reviews.

The goal is to preserve the shape of census tracts as much as possible so researchers can study demographic trends over time. But sometimes tracts are split if they become too populous or merged if an area loses residents. In some cases, changes are made to better reflect reality on the ground, such as a new highway.

Officials have done a good job maintaining standards over the years, said Tim Trainor, a former chief geospatial scientist at the bureau and now president of the International Cartographic Association. But “sometimes there are shenanigans that go on” at the local level as Congress pegs tax breaks and spending to the tracts, he said.

The result is that complex policy debates sometimes land on the desks of Census Bureau geographers. While they strive to be apolitical and make determinations independent of these considerations, their judgments have knock-on effects for a host of programs and incentives. Expanding a tract to include land under an opportunity zone development could change its demographics, influencing the availability of other government funding and incentives.

Bloomberg’s analysis looked at tracts from a decade ago that still existed in 2020 — about 85 percent of all opportunity zones. Changes to boundaries were rare. Only 19 of every 1,000 such tracts had an increase in land area of more than 5 percent, a threshold bureau geographers considered significant when describing the changes to Trump administration officials last year, according to a person familiar with the matter. That compares with roughly 12 out of every 1,000 eligible tracts that weren’t picked. Opportunity zones were twice as likely as that group to see their land area expand by 20 percent or more.

Among the biggest increases: tract 9714 in St. Croix, which grew by 254 percent. Two people informed of the request at the time said they found it inappropriate. Not only was it large, but the reason for doing it was to deliver tax breaks to developers, said the people, who asked not to be identified discussing the lobbying effort.

Jack Thomas, an opportunity zone fund manager, encouraged the territorial government to see if it could bring the tax benefits to an industrial portion of the island where people were more likely to use them to create jobs and drive economic development. One potential beneficiary is St. Croix Renaissance Park, a former Alcoa facility that Thomas spent years redeveloping on behalf of Boston-based Mugar Enterprises Inc.

Thomas, who said he’s no longer involved with the industrial park, is interested in using the tax incentives to set up businesses in the expanded zone and defended the move as a way to help the island recover from two hurricanes in 2017. “This isn’t enhancing Trump’s rich friends — it’s a poor, poor area,” said Thomas, who recently started a hemp farm on another part of the island that’s partly funded by opportunity zone investors. “People have ideas of pirates and all this sort of thing” when they think of the Virgin Islands, he added. “It’s hard to get investment dollars in. But we’re doing it.”

Richard Motta, a spokesman for the territorial government, said the expansion of the opportunity zone “has great potential for enhancing the economy and employment opportunities on St. Croix.” A spokesman for Mugar didn’t respond to requests for comment.

As the Biden administration weighs whether investors will be allowed to claim the tax breaks in expanded tracts, officials will have to wrestle with other issues. Almost 120 opportunity zones shrank by more than 5 percent, according to Bloomberg’s analysis, and the census tracts tied to more than 1,000 zones no longer exist, likely because of mergers or splits, raising questions about whether projects underway in those areas are still entitled to the benefits.

Tradepoint Atlantic, a sprawling logistics facility near Baltimore, is counting on one of the changes to extend tax breaks to its Sparrows Point location, which couldn’t qualify for the incentives because nobody lived in the tract.

After unsuccessfully lobbying the Trump administration to change the rules, the developer settled on a different approach: Merge the property with an opportunity zone across a tributary to the Patapsco River. In 2019, Aaron Tomarchio, a Tradepoint senior vice president, met with Baltimore County officials to see if they could get the Census Bureau to make the change, according to emails reviewed by Bloomberg. He said in an interview that excluding zero-population tracts with industrial sites was a technical flaw, an idea some lawmakers have echoed, and that Tradepoint’s project is “within the spirit and intent of the program.”

That’s not how Joseph Fraker saw it. The former Baltimore County official, who was involved with the process, said he resigned after expressing opposition. “I didn’t really think it was appropriate,” Fraker said. The county “wouldn’t have done this in any other place, and it was purely at the request of the corporation.”

The Census Bureau went ahead with the proposal, creating a new tract that’s 622 percent bigger than the one designated as an opportunity zone. Sean Naron, a spokesman for Baltimore County, said the tract change had buy-in from the community and would provide “significant economic benefits to the entire area.” He declined to comment on Fraker’s departure.

Now, the area’s congressman, Dutch Ruppersberger, wants to ensure the maneuver works. A spokeswoman said he plans to send a letter on Tradepoint’s behalf to Treasury Secretary Janet Yellen asking that the merged tracts become an enlarged opportunity zone. Ruppersberger is also reaching out to other members of the state’s congressional delegation, the spokeswoman said.

Tradepoint has attracted tenants including Amazon, Under Armour and FedEx Corp. since Hilco Global and an investment partner bought the former Bethlehem Steel mill in 2012 and began converting it into a global logistics facility. The tax breaks could benefit future development on the site and attract more companies to set up there, creating jobs, said Tomarchio. “A project of this size and magnitude, it’s incredibly capital-intensive,” he said. “There’s always a need for additional investments.”

A spokeswoman for FedEx said the company would consider using the tax break if it becomes available. Spokespeople for Amazon and Under Armour declined to comment.

Across the country, in Raton, New Mexico, Scott Berry is also hunting for investments. The town of 6,000, about 115 miles northeast of Santa Fe, once a coal-mining center, has fallen on hard times. So Berry, the city manager, was excited when a developer came to town with a proposal to spend more than $8 million refurbishing the Golden Rule general store if he could tap the area’s tax incentives. There was just one hitch: The property fell 300 feet outside the tract where the benefits were available.

Starting in March 2019, Berry set about changing that. He wrote to New Mexico’s congressional delegation and eventually found his way to the Census Bureau. The approved change is almost microscopic, representing an addition of 0.02 percent to the land area of a tract that sprawls over 840 square miles of northern New Mexico. But it was enough to cover the site of the store and a part of town where others were considering projects, Berry said. Now, he’s hopeful the Biden administration will extend the benefits to the additional area.

“It would be a real momentum shift for us,” said Berry. “This could be a big win for Raton.”

—With assistance by Jason Grotto and Dave Merrill