Everybody seems to be talking about a wealth tax heading into next year’s presidential election. Clients are no different.

Should the wealthy be taxed more?

“The answer will depend on who’s asked the question,” said Twila Midwood, an Enrolled Agent at Advanced Tax Centre in Rockledge, Florida. “Our wealthy clients are appalled. I’d venture that the majority of taxpayers don’t completely understand the tax rate system to render an informed opinion.”

Clients say that “it’s a bad idea. No one desires to pay more tax. People do like it for ‘others’ to pay tax,” said Daniel Morris, a CPA and senior partner at Morris + D’Angelo CPAs, in San Jose, California.

“I frequently hear clients express their opinions that the wealthy get all the breaks and should pay more tax. ‘Wealthy’ is a relative term, of course,” said Debra James, an EA at Genesis Accounting Mgmt. Services in Lorain, Ohio.

“Considering that my firm specializes in serving the needs of high-net-worth individuals and their family businesses, that sort of comment puts our clients right in the cross-hairs,” said James McGrory, a CPA and shareholder at Drucker Scaccetti, in Philadelphia. “Several of my HNW clients who live in New York and Connecticut in particular already believe they’re bearing a substantial tax burden, especially since the loss of the SALT deduction. Other HNW clients have told me they wouldn’t mind bearing a larger tax burden as long as the U.S. government would spend their tax dollars more wisely.”

Fair shares

A “wealth tax” is precisely named: Many of the richest Americans have plentiful assets but little income, putting them beyond the reach of conventional income taxes. In Europe, some nations retain some form a wealth tax, though in recent years other countries have scrapped theirs.

“Most of my clients think that they pay a fair share of their income to taxes — except for my wealthiest,” said Morris Armstrong, an EA and registered investment advisor at Armstrong Financial Strategies, in Cheshire, Connecticut. “She thinks that those richer than her should pay more. In my opinion, she sums up the problem quite nicely, in that there’ll always be some people who think that they should pay less tax than someone else.”

“It’s also why the idea of taxing the uber-rich may gain traction, Armstrong added. “The base of the pyramid is enormous compared to the tip.”

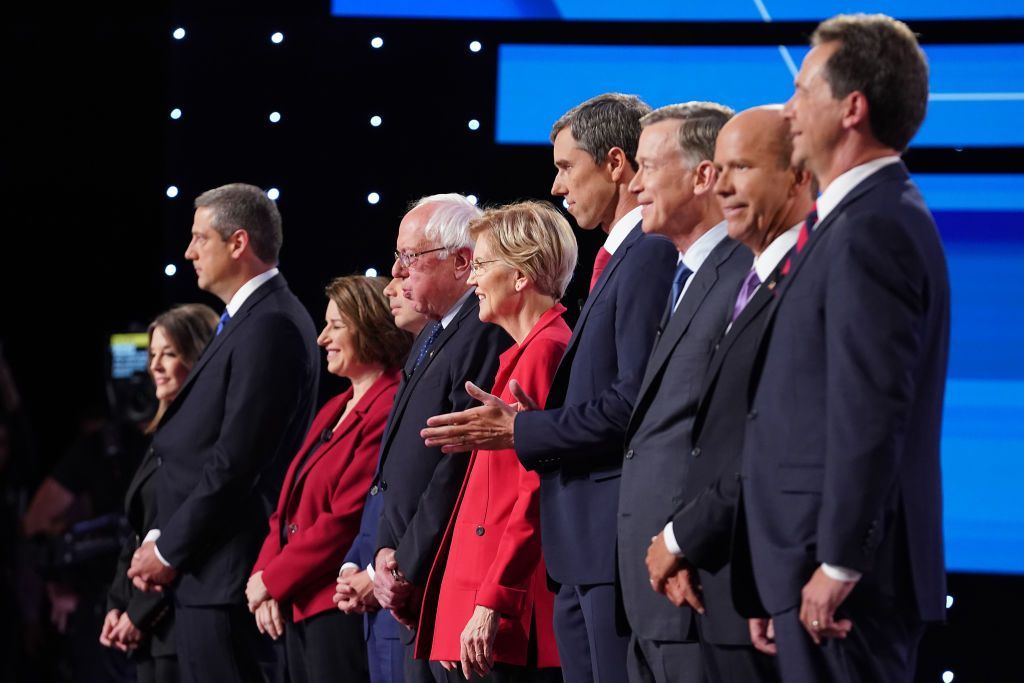

Sen. Elizabeth Warren is among Democratic frontrunners to long advocate a tax on the wealthy (both individuals and businesses), though one study claims her campaign overestimates the tax’s potential proceeds by at least $1 trillion.

“My clients are in the wealthy category and for the most part think that plan is a joke,” said Bruce Primeau, a CPA and president at Summit Wealth Advocates, in Prior Lake, Minnesota. “Most of the tax laws currently in place are slanted against the wealthy in that they pay a higher income tax rate the more they make and, of course, they lose deductions or credits the more they make. To say that the ‘wealthy need to pay their fair share’ is a statement by someone who clearly doesn’t understand the current tax law.”

“Wealth transfers from those that have it to those that want it never play well with the haves,” Morris said.

Convenience

Preparers themselves also seem split on the idea of the tax.

“Where folks get the idea that people in higher-income brackets get all the breaks, I don’t know. We know that those folks are often phased out of education credits, child tax credits and health insurance premium tax credits, among other things. They may also pay the Alternative Minimum Tax, net investment tax, additional Medicare tax and so on,” James said.

John Dundon, an EA and president of Taxpayer Advocacy Services in Englewood, Colorado, reports “a mixed response. Several of the world’s most financially endowed people are doing incredibly fascinating things for the planet and society with their vast resources — Bill Gates and Warren Buffet, in particular,” he said. “These fine men are the exception to the general opinion that most people of this persuasion do little for society or the planet and shouldn’t be entitled to passing on tax-advantaged generational wealth to heirs.”

“Wealthy people understand that deficit spending is long-term idiotic. Wealthy people desire to save more, reinvest, create jobs and move the world forward,” Morris said. “They also understand that in this populist culture of now, taxing wealth is convenient and … there will be tax increases.”