An estimated one in every 10 American adults loses money in a phone scam every year — almost $10 billion overall. Tax season, of course, brings its own flood of fraud schemes — and there are even scams circulating now regarding the coronavirus. Reassurance about, and countermeasures to, money scams have become new branches of client service.

“Clients are and always have been concerned about frauds and scams,” said Debra James, an Enrolled Agent at Genesis Accounting Management Services in Lorain, Ohio. “We tell them the facts as we know them, one being that the IRS will never call prior to written correspondence and will never threaten lawsuits without a great deal of prior interaction, certainly not over the phone. We get many calls asking if the calls they get are legitimate, and we assure them that they are not.”

“Every time I have someone contact me regarding a call or letter or an email, I tell them to ignore these calls and we go over best practices to protect ourselves,” said Manasa Nadig, an EA and owner at MN Tax and Business Services and a partner at Harris Nadig, in Canton, Michigan. “I bring to their attention that the IRS and Social Security Administration never call taxpayers and are requiring tax professionals to have a written data security plan.”

“It’s hard to tell whether my clients are concerned in general or because I continually remind them of various scams and fraud alerts,” said Phyllis Jo Kubey, an EA in New York. “One of the toughest habits to break for my clients is emailing tax documents and other sensitive information. I use a secure messaging platform [and] my clients are getting better, but some still slip, whether it’s forwarding a W-9 that their subcontractor sent to them or a tax document they just downloaded on their phone.”

“When I tell my clients I won’t open an email attachment, and I tell them why, they gain a new level of understanding,” Kubey added.

Making the list

The most recent IRS Dirty Dozen tax scams includes several that clients might run into: fake emails, text messages, websites and social media attempts to steal personal information; tax-related ID theft when someone uses a stolen Social Security number or ITIN to file a phony return; or tax-time phone scams where aggressive criminals pose as IRS agents to steal money or personal information.

James McGrory, a CPA and shareholder at Drucker Scaccetti in Philadelphia, recently had a wealthy family client who was contacted by someone purportedly from the Social Security Administration requesting her bank account information. “It was scary how much identifying information the scammer knew about the client,” McGrory said.

“While the client was extremely upset about the call, she was wise to not provide any additional information and she immediately hung up,” McGrory said.

The IRS Identity Theft Central page has information on helping preparers’ clients (both business and individuals) recover from ID fraud and theft, as well as information on liabilities. The American Institute of CPAs also offers an ID-theft prevention checklist and toolkit.

“On the occasion when we do get rejected returns because of a prior fraudulent filing, indicating that there is some ID theft, we have a protocol for completing the necessary forms for both federal and state to send in with their paper-filed returns at no additional charge,” James said. “We also counsel them on additional steps to take to protect themselves and to allay their fears.”

Winning the fight?

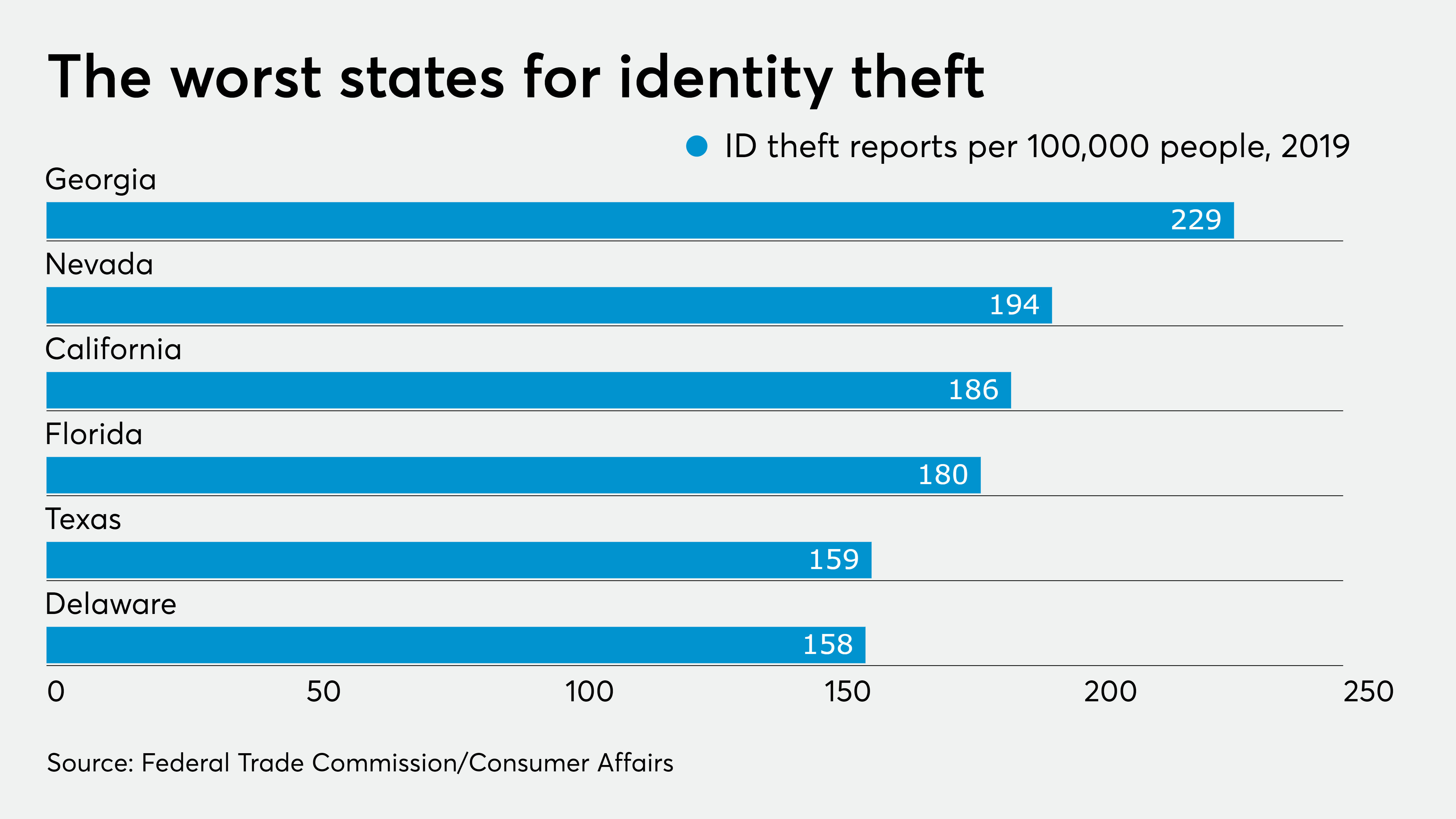

Tax fraud is supposedly down but some 15.4 million consumers still reported being victims of ID theft or fraud in recent years. Researchers claim that’s one of the highest levels since they began tracking the crime.

“Fortunately, the ID-theft issues we’ve seen with returns dropped significantly over the past two years,” Lawrence Pon, a CPA in Redwood City, California, adding that clients who previously had ID-theft issues now have the identity protection personal identification number, or IP PIN, from the IRS. “If we suspect any issues, we work with the IRS and state to get the clients that extra protection,” Pon said.

“Luckily none of my clients have been victims,” Pon added. “Of course this is a concern … The scammers never stop.”