The Internal Revenue Service is reopening the registration period for parents to list their kids so they can receive an extra $500 per child in economic impact payments under the CARES Act.

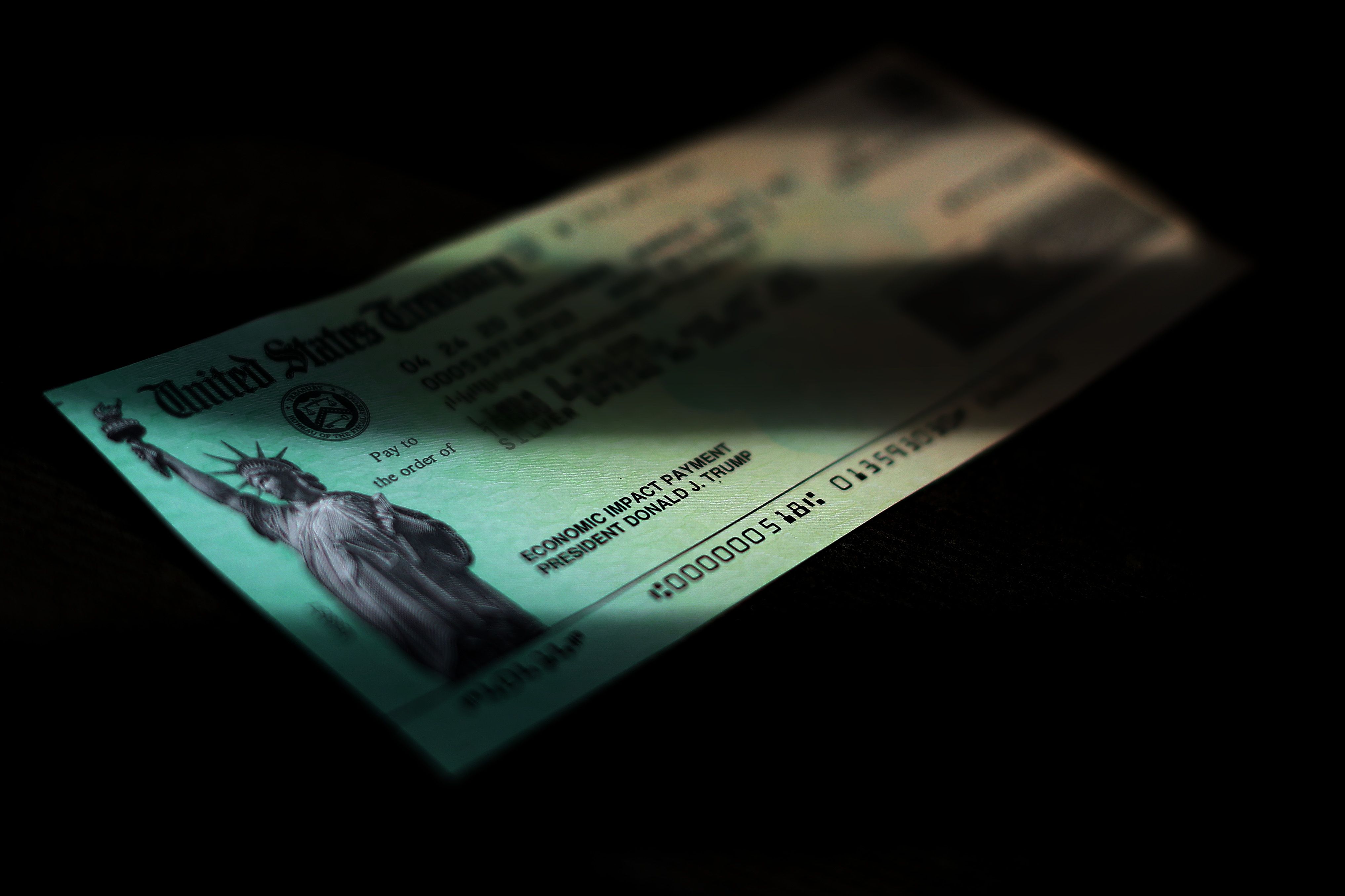

The $2.2 trillion stimulus package that Congress passed in March to help blunt the economic impact of the novel coronavirus pandemic included $1,200 in “Economic Impact Payments” for adults, plus an additional $500 per child. To rush the payments out, the IRS relied on tax filings for 2018 and 2019 from taxpayers, but many of those tax returns didn’t include information about the youngest children, especially after the IRS eliminated the dependent exemption with the 2017 tax reform, nor did the service have the information needed for people who don’t normally file tax returns, such as low-income taxpayers, and recipients of Social Security, veterans and railroad retirement benefits.

In response, the IRS created a Non-Filers tool so even people who didn’t file their taxes could still receive the stimulus payments, while also barring incarcerated and undocumented taxpayers from receiving the payments. However, the IRS also kept the Non-Filers tool available for only a few weeks in April and told taxpayers to hurry and register or else they would have to wait until next year to claim the payments (see story). But after receiving many complaints that the stimulus payments were incorrect or never arrived, along with other problems, the IRS is now making the Non-Filers tool available again but only until the end of September.

The IRS is asking eligible federal benefit recipients to use the Non-Filers tool starting Aug. 15 through Sept. 30 to enter information on their qualifying children to receive the supplemental $500 payments. Those eligible to provide the information include people with qualifying children who receive Social Security retirement, survivor or disability benefits, Supplemental Security Income, railroad retirement benefits and Veterans Affairs compensation and pension benefits and did not file a tax return in 2018 or 2019.

The IRS expects the catch-up payments, equal to $500 per eligible child, will be sent by mid-October.

“IRS employees have been working non-stop to deliver more than 160 million Economic Impact Payments in record time. We have coordinated outreach efforts with thousands of community-based organizations and have provided materials in more than two dozen languages,” said IRS Commissioner Chuck Rettig in a statement Friday. “Given the extremely high demand for EIP assistance, we have continued to prioritize and increase resource allocations to eligible individuals, including those who may be waiting on some portion of their payment. To help with this, we are allocating additional IRS resources to ensure eligible recipients receive their full payments during this challenging time.”

For beneficiaries of Social Security, SSI, veterans’ or railroad retirement benefits who already used the Non-Filers tool after May 5 to provide information about children, no further action is needed. The IRS will automatically make a payment in October.

Those who receive any of those benefits and haven’t used the Non-Filers tool to provide information on their child should register online by Sept. 30 using the Non-Filers tool. However, anyone who has already filed or plans to file either a 2018 or 2019 tax return should file the tax return and not use this tool.

People who can’t access the Non-Filers tool can still submit a simplified paper return following the procedures described in this FAQ on IRS.gov.

This may be the final chance to submit the information this year. The IRS said any beneficiary who misses the Sept. 30 deadline will need to wait until next year and claim it as a credit on their 2020 federal income tax return.

Those who received their original EIP by direct deposit will also have any supplemental payment direct deposited to the same account, while others will receive a check.

Eligible recipients can check the status of their payments using the IRS’s online Get My Payment tool. A notice verifying the $500-per-child supplemental payment will be sent to each recipient and should be retained with other tax records.

The IRS noted that other non-filers can still receive a payment, but they have to act by Oct. 15. While most Americans have already received their EIPs, the IRS said people with little or no income and who aren’t required to file tax returns still remain eligible to receive stimulus payments. People in this group should also use the Non-Filers’ tool, but they need to act by Oct. 15 to receive their payment this year.

The Non-Filers tool is aimed at people with incomes generally below $24,400 for married couples, and $12,200 for singles. That includes couples and individuals who are experiencing homelessness. People can qualify, even if they don’t work or have no earned income. However, low- and moderate-income workers and working families who are eligible to receive special tax benefits, such as the Earned Income Tax Credit or Child Tax Credit, can’t use this tool. Instead, they need to file a regular tax return by using IRS Free File or some other method.

The IRS is still dealing with a number of other issues holding up the stimulus payments for some taxpayers. Those include:

- Spouse’s past-due child support. The IRS said it’s actively working to resolve cases where part or all of an individual’s payment was taken and applied to their spouse’s past-due child support. People in this situation don’t need to take any action. The IRS said it will automatically issue the portion of the EIP that was applied to the other spouse’s debt.

- Spouses of deceased taxpayers. When the CARES Act passed in March, the IRS originally implemented the legislation in accordance with processes and procedures relating to the 2008 stimulus payments (which were sent to deceased individuals). After further review this spring, the Treasury decided that those who died before receipt of the payments should not receive the advance payment. As a result, the EIP procedures were modified to stop future payments to dead people. The cancellation of uncashed checks is part of this process. Some EIPs to spouses of deceased taxpayers were canceled. The IRS said it’s actively working on a systemic solution to reissue payments to surviving spouses of deceased taxpayers who were unable to deposit the initial EIPs paid to the deceased and surviving spouse. For EIPs that have been canceled or returned, the surviving spouse will automatically get their share of the EIP.

The IRS has come under fire from taxpayers and lawmakers in Congress over the delays and said it has taken steps to get payments to as many eligible individuals as possible. A recent oversight report said the IRS correctly figured the amount due for 98 percent of the payments issued. However, the IRS acknowledged the significance of the issue for those who haven’t yet received their full payment. The service is still looking at ways to help people get the right amount of the stimulus payment and will continue to provide updates on further improvements as they occur.

For more information on the EIP, including the latest answers to frequently asked questions and other matters, visit IRS.gov/coronavirus, which provides information about issues such as why the payment received is less than $1,200, why someone is considered ineligible to receive a payment, and why someone might not be eligible to receive the $500 per qualifying child payment.